Key inflation measures for July 2025

CPI rose to 3.8% in July from 3.6% in June amid signs that the government is struggling to control inflation.

Higher air fares in particular were one of the main drivers of the increase.

The Consumer Prices Index (CPI) rose 3.8% in the 12 months to July 2025, up from 3.6% in the 12 months to June.

On a monthly basis, CPI increased by 0.1% in July 2025, compared with a fall of 0.2% in July 2024.

CPI is now at its highest level since January 2024 and at a 19 month high.

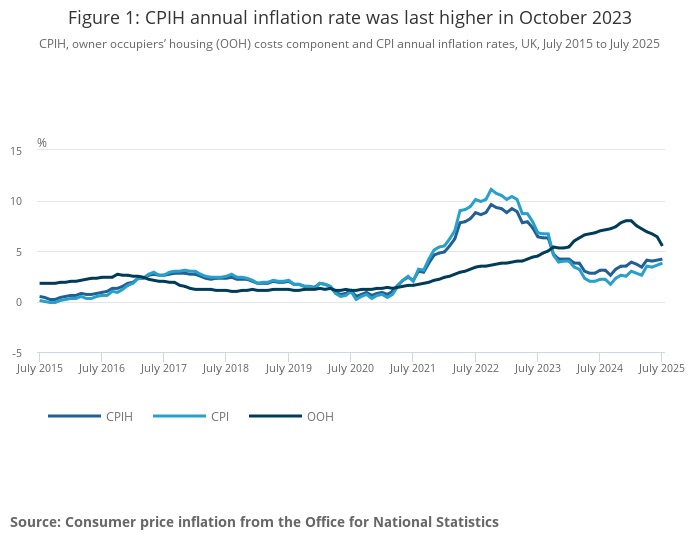

The Consumer Prices Index including owner occupiers' housing costs (CPIH) rose 4.2% in the 12 months to July 2025, up from 4.1% in the 12 months to June - the highest level since October 2023.

On a monthly basis, CPIH was little changed in July 2025.

The ONS said that transport costs, particularly air fares, made the largest "upward contribution" to the monthly change in CPIH and CPI annual rates.

Housing and household services, particularly owner occupiers' housing costs, made a partially offsetting, downward contribution to CPIH.

One of the most significant increases was in food and non-alcoholic beverages with prices rising 4.9% in July (up from 4.5% in June). In contrasts, alcohol and tobacco increases fell from 6.4% in June to 5.7% in July.

Education costs rose by 7.5% in July, one of the highest increases in any areas.

Core CPIH (CPIH excluding energy, food, alcohol and tobacco) rose 4.2% in the 12 months to July 2025, down slightly from 4.3% in the 12 months to June. The CPIH goods annual rate rose from 2.4% to 2.7%, while the CPIH services annual rate was unchanged at 5.2%.

Core CPI (CPI excluding energy, food, alcohol and tobacco) rose by 3.8% in the 12 months to July 2025, up slightly from 3.7% in the 12 months to June. The CPI goods annual rate rose from 2.4% to 2.7%, while the CPI services annual rate rose from 4.7% to 5.0%.

The 12 month RPI measure, an older inflation figure still in use in some sectors, rose from 4.4% in June to 4.8% in July.

Commentators said the increase would be of some concern to the government.

"This was brought into focus by the closely watched services inflation measure rising more than expected to 5% year-on-year. That said, volatile airfares helped drive inflation higher over July, which could reverse in coming months. Inflation in the near term was always going to put greater emphasis on the labour market getting weaker to justify interest rate cuts. Today’s upside surprise only reiterates this further."

Luke Bartholomew, deputy chief economist, at Aberdeen said: “Inflation was always likely to rise today, but this report is definitely on the hotter side.

"In particular, services inflation, which the Bank of England watches very closely as a measure of underlying inflation pressure, popping higher will be a source of concern among policymakers.

"With inflation likely to rise further in coming months and wage growth gradually slowing, it is quite possible we move back to a period of sustained negative wage growth. All of which will keep the economy feeling more “stagflationary” than comfortable. The outlook for interest rates is therefore looking more uncertain. We continue to expect another cut in November, but the risk of a more sustained pause in the cutting cycle has increased.”

• This is a developing story. Check back later for more details and reaction.