Dynamic Planner website

The Consumer Duty has made the industry more professional and given clients better financial outcomes.

That’s the independent conclusion of a large-scale new advice report from fintech Dynamic Planner.

Two years into Consumer Duty it surveyed advice professionals to gauge the impact of the Consumer Duty changes introduced by the FCA in 2023.

The report concluded that, “the benefits are becoming evident – and the regulation is beginning to play its intended role as a bedrock for change.”

It said the focus on demonstrable client value has pushed the industry towards more professional, evidence-based practices, which have put firms in a better position to capture tech-driven efficiencies and seize the opportunities that lie ahead.

This also applies to the FCA's proposed targeted support plans and new approaches to delivering ongoing advice, the report said.

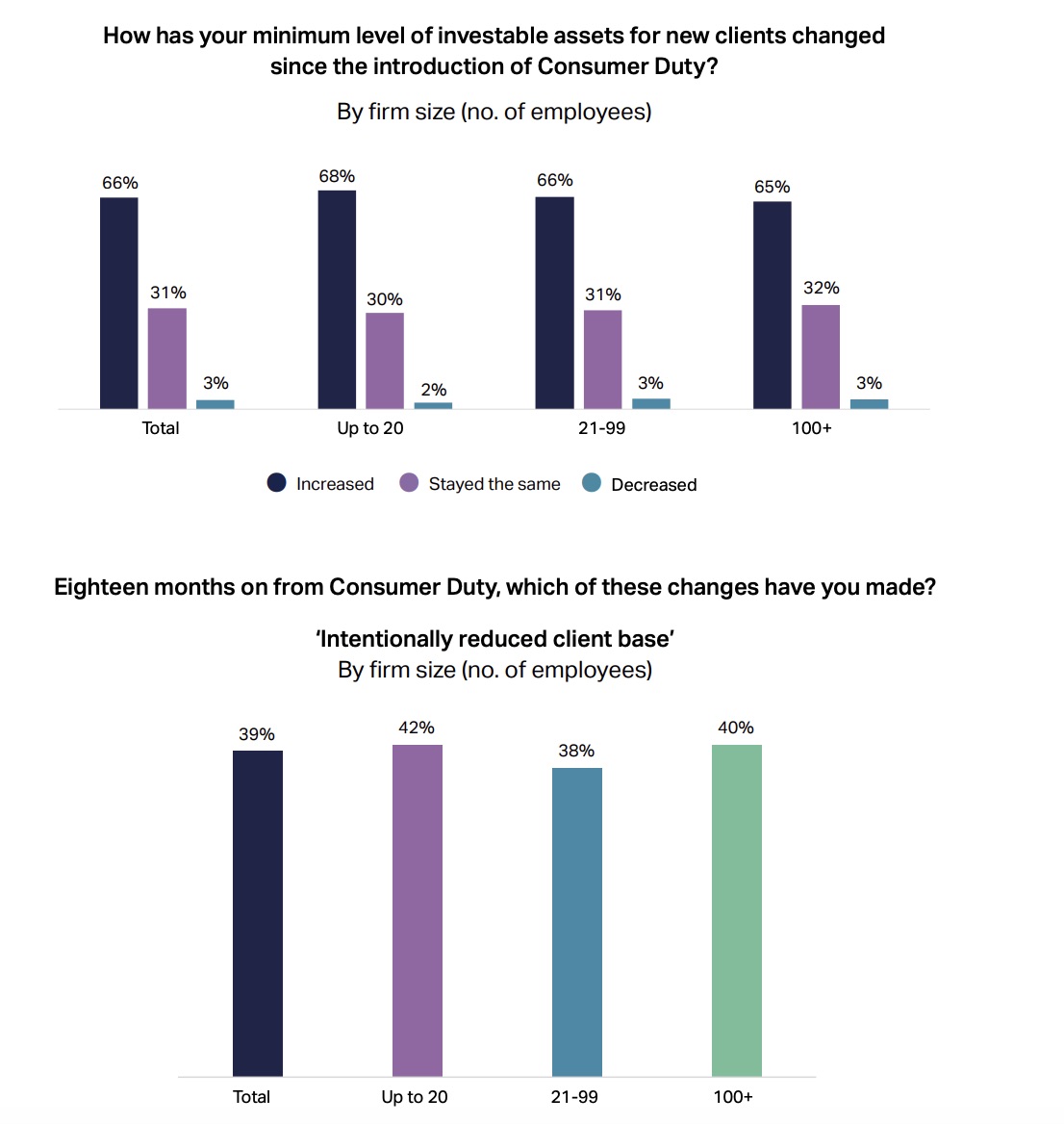

One problem Consumer Duty introduced was the client off-boarding phenomenon due to costs rising, the report said. This saw two-thirds of firms increase their minimum investible assets after the introduction of the regulations, while around two in five let existing clients go as serving them became uneconomical, according to the research.

Source: Dynamic Planner report: Advice 2025: Consumer Duty two years on

The report said it was an “unfortunate unintended consequence of the Duty” but which now seems likely to have been temporary, with new routes to advice and guidance opening up for investors with smaller pots.

Technology has helped by driving productivity and pushing down the cost to provide firms’ holistic advice businesses, according to the report.

Meanwhile, the FCA has committed to a more pragmatic approach and to building future regulation on the Duty where possible. That means firms are no longer braced for further big regulatory hits and can operate with greater confidence, the report said.

It added: “A regulatory environment that delivers for all is a difficult jigsaw to complete, but the direction of travel appears positive. In the coming months and years, Consumer Duty has the potential to shape an invigorated industry in which firms can innovate and thrive, and a vastly greater share of the population is supported to achieve better financial outcomes.”

Chris Jones, financial services director at Dynamic Planner, said: “With the impact on culture and conduct becoming clear as the regulation beds in, some of the formal requirements and bureaucracy of the Duty may be scaled back – the FCA has already done away with the need for firms to have a dedicated in-house champion, for example.

“However, the principle remains at the heart of the regulatory agenda, providing the basis for targeted support and more. Aligning with the government’s growth agenda, Consumer Duty has the potential to become what advisers have long argued for: a form of regulation that recognises their desire to act in their clients’ best interests and gets out of their way to let them do just that.”

• Dynamic Planner’s Advice 2025 survey was conducted by Research Without Barriers in the first quarter of 2025. The research captured the views of 406 advice professionals, including 304 financial advisers, 52 business decision makers and 50 Paraplanners, from firms of all sizes across the UK.

• Financial Planning Today Analysis: The Consumer Duty has improved standards in the financial services sector - but at a price. Provider and adviser firms have raised their standards but in doing so costs have gone up and some less profitable clients have been jettisoned. Taken historically, this marks just another step in the steady move upmarket of the financial advice and Financial Planning sectors. It makes the latest FCA move to introduce targeted support and perhaps other forms of 'cut down' guidance for the masses a logical step to avoid advice of any kind being pushed out of the reach of millions. Given the government handing a growth mandate to the FCA, the Consumer Duty may mark 'peak' consumer protection and the mantra for the next few years will be deregulation and cutting red tape. One positive aspect is that now the Consumer Duty is well embedded there appear to be no more 'nasties' lurking in the regulatory ether so firms can plan and get back to focusing on growing their businesses and serving clients well. Clients too should find long term benefit from the Consumer Duty changes.