XPS website

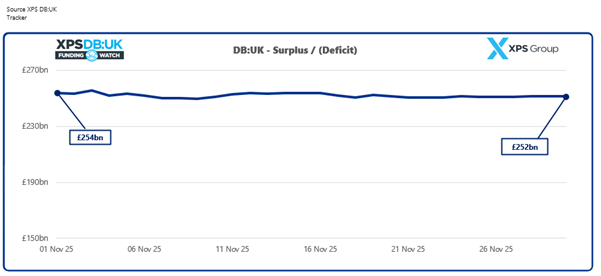

UK DB pension schemes continue to enjoy extremely positive funding positions, with XPS Group reckoning aggregate surpluses of £252bn on long-term targets, up from £187bn the previous year.

Schemes held £1,215bn in assets (against £963bn in liabilities) marking only a slight month-on-month dip in funding levels.

Scheme assets dipped slightly over November, as a modest rise in bond yields reduced the value of matching assets, and global equities delivered softer than expected returns.

Liabilities also eased marginally, driven by a small rise in gilt yields.

Source: XPS

The strong funding levels of many UK pension schemes were maintained through November in the lead up to the Autumn Budget, XPS said.

The Chancellor unveiled greater flexibilities taking effect from April 2027 with one-off payments to members from pension scheme surpluses no longer being treated as unauthorised.

The reform gives trustees and employers further options to use surplus funds, and may allow members to share more directly in the benefits of stronger scheme funding.

Graham Robinson, senior consultant at XPS Group said: “With the continued high funding levels within DB pension schemes, the enhanced flexibility around surplus distribution announced in the recent Budget is welcome news to trustees and members alike.

“However, careful consideration of all stakeholders will be required when considering any surplus distribution from well-funded schemes.”