Disability and inclusion campaigner Eddie Grant

PFS director and disability and inclusion campaigner Eddie Grant FPFS, a Chartered Financial Planner, explains what the 'disability dividend' is and how inclusion can strengthen workforces, customers and communities.

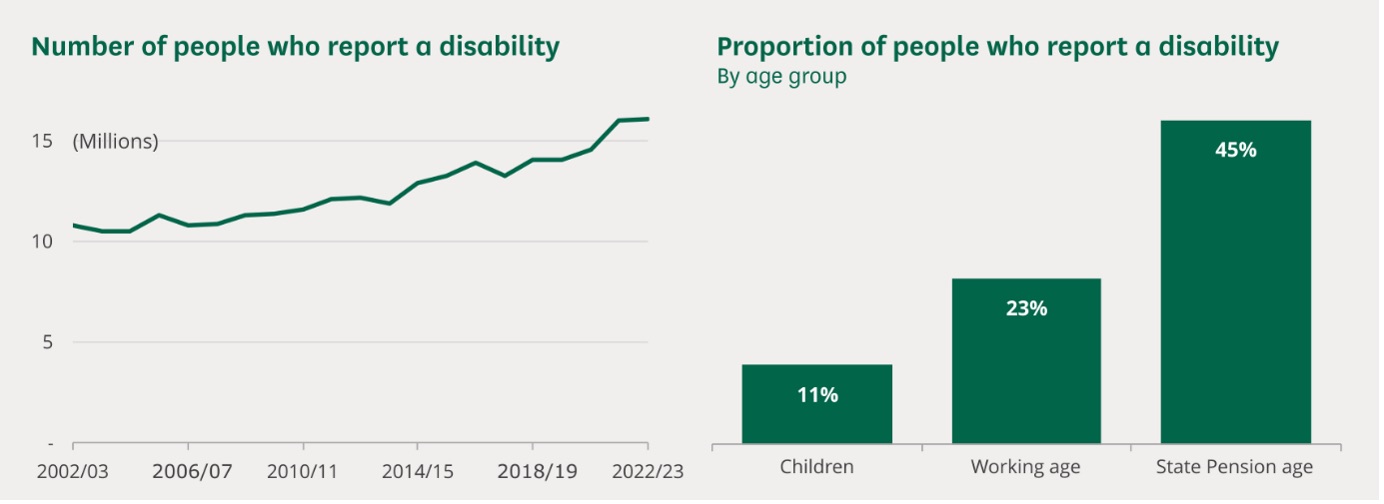

One in five UK adults is disabled, (FCA data, 2024) yet disabled people remain underrepresented in workforces and underserved as customers, which is surprising as the Purple Pound (the collective spending of disabled people) is worth £446 billion to the UK economy (Money Advice Trust, 2025).

Source: UK Parliament – UK Disability Statistics UK disability statistics: Prevalence and life experiences - House of Commons Library

What has struck me most in my first months as the UK Cabinet Office Disability & Access Ambassador is the sheer breadth of activity across our profession.

Everywhere I look, I see initiatives - large and small - driven by passionate champions, many with personal experiences, who are giving their time, skills, and energy to improve accessibility for customers and colleagues alike.

My wife, Marina, uses a wheelchair. While her access has improved over the years, it is often a bolt on to an existing process. Far too often access is convoluted. While the outcome maybe the same, the journey is very different for disabled people. Access to insurance and Financial Planning can also be full of incremental frustrations at times.

The Mayfield Review (Keep Britain Working) highlighted that disabled people face stark barriers to employment, with only 53% in work. Nearly three times more are likely to be economically inactive than non-disabled peers. Disabled people are more likely to be self-employed, as often this feels like the only option. It calls for systemic reform to improve workplace inclusion and retention.

Over 100 firms in our sector have already signed up to the Government’s Disability Confident scheme, committing to inclusive recruitment and retention. This is a powerful way to address the, “persistent structural barriers” identified in the Keep Britain Working review.

Disability cuts across every demographic. Its impact is deeply personal, but the solution is collective: when disabled people are included from the start - in design, delivery, and decision-making - products and services become better for everyone.

Through the 19 Disability sector Ambassadors, I have been able to spend time chatting to disabled people to understand the barriers they experience with our profession.

Paralympians have shared how empathetic underwriting – where data is used intelligently – makes applying for insurance and protection smooth and respectful. But when handled poorly, it becomes intrusive, frustrating, and often ends in declined cover. This isn’t just about insurance and protection - it affects mortgages, ability to train and financial health and resilience. A poor experience weakens trust in our profession.

The BIBA Access to Insurance signposting scheme is a great opportunity for disabled people to access cover, especially when originally declined. Employers, too, can play a vital role by offering group benefits that support disabled employees, especially if disability arises during their career, with providers often taking a pragmatic approach to early intervention, rehabilitation and return to work policies.

So, three simple actions for firms to consider:

The new Chartered Insurance Institute Managing Customer Vulnerability Guide is a great example of the collective expertise across our profession full of hints, tips and strategies to help firms deliver great outcomes for customers and employees.

Accessibility must be instinctive - woven into every decision, building every product and policy with disability in mind rather than as an afterthought.

Eddie Grant is an advocate for the insurance and Financial Planning professions. He is UK Cabinet Office Disability and Access Ambassador for Insurance, a PFS Director, a Past President of the Personal Finance Society (PFS) and its longest-serving non-executive director. He also serves on the board of the European Financial Planning Association which has 101,000 members.

This email address is being protected from spambots. You need JavaScript enabled to view it.