Defaqto's new MPS report

The Managed Portfolio Services market has expanded and diversified so rapidly that MPS portfolios are likely to have overtaken multi-asset funds in total recommendations, according to new data.

Data and software provider Defaqto analysed more than 2,000 platform portfolios to come to its conclusion.

It claimed its newly-released Defaqto in Focus: MPS report is the most comprehensive analysis of the landscape ever produced.

The report showed the number of available MPS funds has surged, with more providers entering the market, expanding choice for advisers.

There are now 50% more firms in the retail market than there were in 2016 and more than 120 firms today offer an increasing number of propositions and portfolios. Driving the convergence of MPS and multi-asset recommendations by advisers, 2,029 platform portfolios are currently available.

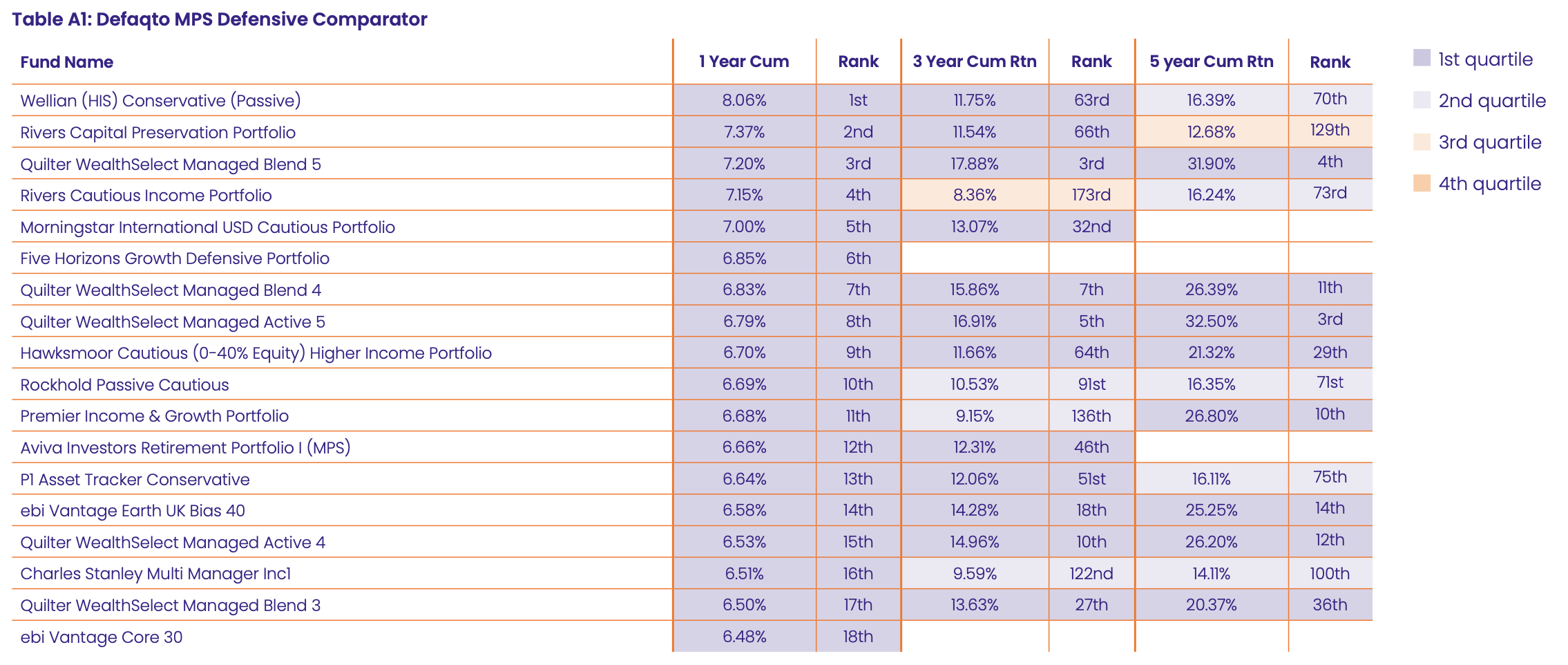

The analysis showed a huge spread of returns over three and five year periods and examination of MPS costs showed an active solution can be cheaper than passive.

Table A1 shows the cumulative performance over one, three and five years, for each Comparator peer group to the end of May 2025. Source: Defaqto.

Andy Parsons, head of investment & protection at Defaqto, said: “In recent years, the MPS market has undergone remarkable growth – yet it remains shrouded in complexity and, all too often, unnecessary opacity.

“Perhaps the biggest market trend is the growth of MPS as an outsourcing solution, with assets under management showing a clear upward trajectory. “We would suggest that the crossing point between multi-asset funds and MPS portfolios may now have been reached with MPS recommendations surpassing multi-asset. The question is: will this remain given the FCA’s investigation into MPS?”

Cost transparency continues to be a key priority for advisers according to the company and the analysis challenged some assumptions about what different investment styles should cost. It revealed that, while passive portfolios typically remain the lowest cost, there are surprising overlaps.

In some cohorts, ESG portfolios are priced similarly to active, yet may actually deliver efficiencies more in line with passive approaches. Conversely, some active portfolios are available at costs comparable to passives, challenging perceptions that active always comes at a premium.

Mr Parsons said: “Headline service fees alone can be misleading, and only total cost paints the full picture. We see wide bands between the highest and lowest costs which reinforces the need for advisers to look beyond labels and consider how style, structure, and underlying fund composition impact total expense.”