Number of macro firms has grown

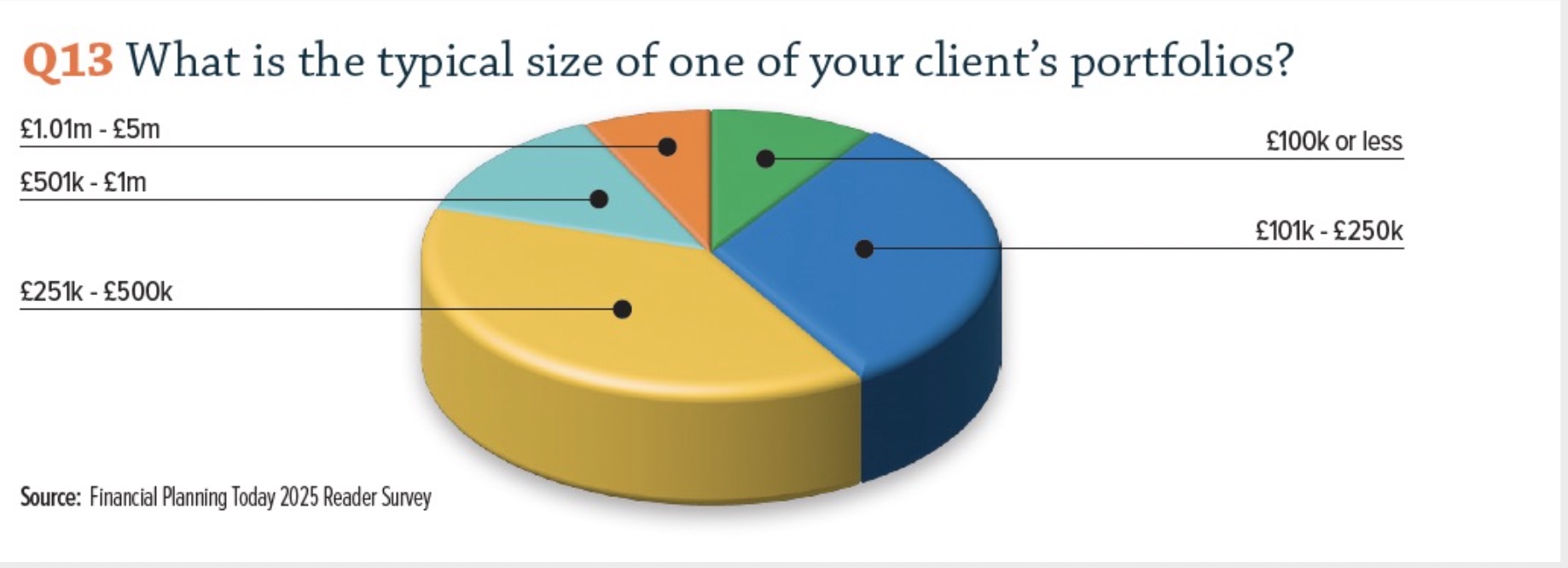

The number of Financial Planners saying they serve clients with portfolios of more than £1m rose by 75% in the last year, according to Financial Planning Today's annual survey of the profession.

This year 7% of firms said they were advising clients with a typical portfolio size of more than £1m, almost double the 4% who reported the same amount in 2024.

The results support a prediction that the FCA’s Consumer Duty, introduced in 2023, would drive Planners towards higher net worth clients because of increased costs.

According to our Reader Survey, average funds under advice or management per firm rose to £840m, up from £690m in 2024, with the average client portfolio size topping the half million mark at £516,000, up from £491,000 in 2024.

For the first time 23% of readers work in a firm which, on average, serves more than 2,000 clients, the first time the number has breached the 20% barrier. A quarter of Financial Planners now work in larger planning firms.

There was a slight drop in the number of larger firms looking after more than 1,000 clients. In total 31% of Financial Planners work in firms advising more than 1,000 clients, compared to 32% last year.

By far the most popular professional bodies were the Personal Finance Society (63%) and parent organisation The Chartered Insurance Institute (53%), similar to last year. Some 24% of readers were members of the Chartered Institute of Securities and Investments (CISI).

Among other professional bodies cited by respondents (some readers were members of more than one) were the LIBF (21%), SOLLA (8%), STEP (6%), the CFA (3%) and PIMFA (2%).

You can subscribe from £9.99 a month and you can unsubscribe at any time on this rate. You can also save money with longer term packages. if you are not ready to subscribe you can sign up for our Free registration level which gives valuable access to up to 10 articles per month.