IA website

Retail fund inflows rose to £1.1bn in April despite heightened geopolitical uncertainty, according to the latest data from the Investment Association, the fund managers' trade body.

Compared to inflows in April 2024 of £3.2bn, the sales recovery is modest but still a positive sign amid a challenging investing environment, said the IA.

It pointed out that March and April net sales are traditionally boosted by the ISA season as investors make the most of the changing tax year and new contribution allowances.

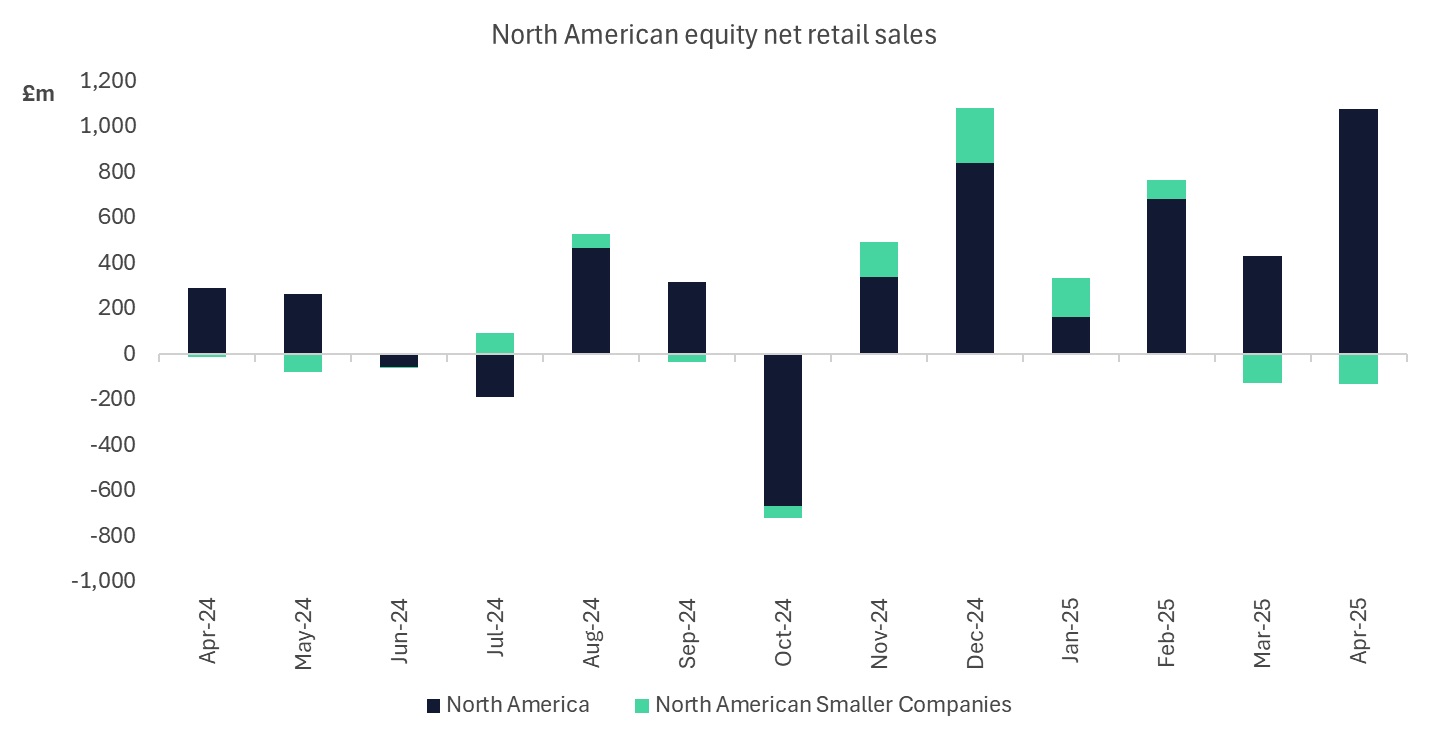

Overall, equity funds saw the strongest net retail sales at £962m, led by North American equities (£948m).

Despite uncertainty around tariffs and trade policy in the US, North American equity inflows remained strong at £948m.

The IA said: “While this may be a result of more risk-on investors ‘buying the dip’, the high inflows to money market funds show prevailing caution as investors wait to see how markets will settle. In equities, we also see inflows to Europe continue as some investors look to increase diversification away from North America.”

Miranda Seath, director, market insight & fund sectors at the IA, said: “A second consecutive month of net fund inflows suggests that investors do retain a degree of confidence, even as global economic uncertainty continues.

“While part of the pickup in flows is seasonal – many people have been making the most of their £20,000 ISA allowance before the 5 April tax-year deadline – we are also seeing genuine momentum in the markets.

"Notably, those willing to take on more risk have been investing in North American equities, buying the dip as valuations have fallen. This helped to give April’s inflows an extra boost.”

The IA’s key findings for April:

Funds under management and net sales – April 2025

|

|

Funds Under Management |

Net Retail Sales |

Net Institutional Sales |

|

April 2025 |

£1.45 billion |

£1.1 billion |

-£3.8 billion |

|

April 2024 |

£1.47 billion |

£3.2 billion |

-£911 million |

Source: The Investment Association