InvestAcc's website

Group revenues more than doubled to £6m for InvestAcc for the six months ended 30 June (H2 2024: £2.5m).

Pension administration services and wealth management fees accounted for 52% and 21% of total income respectively.

InvestAcc saw the number of active pension schemes is manages increase 13,940 (12% growth from 31 December) in the first half of the year.

Profits before tax and interest were £1.3m for the period (H2 2024: £0.1m loss). Including tax and exceptional costs related to acquisitions and restructuring, the firm saw an operating loss of £3.1m.

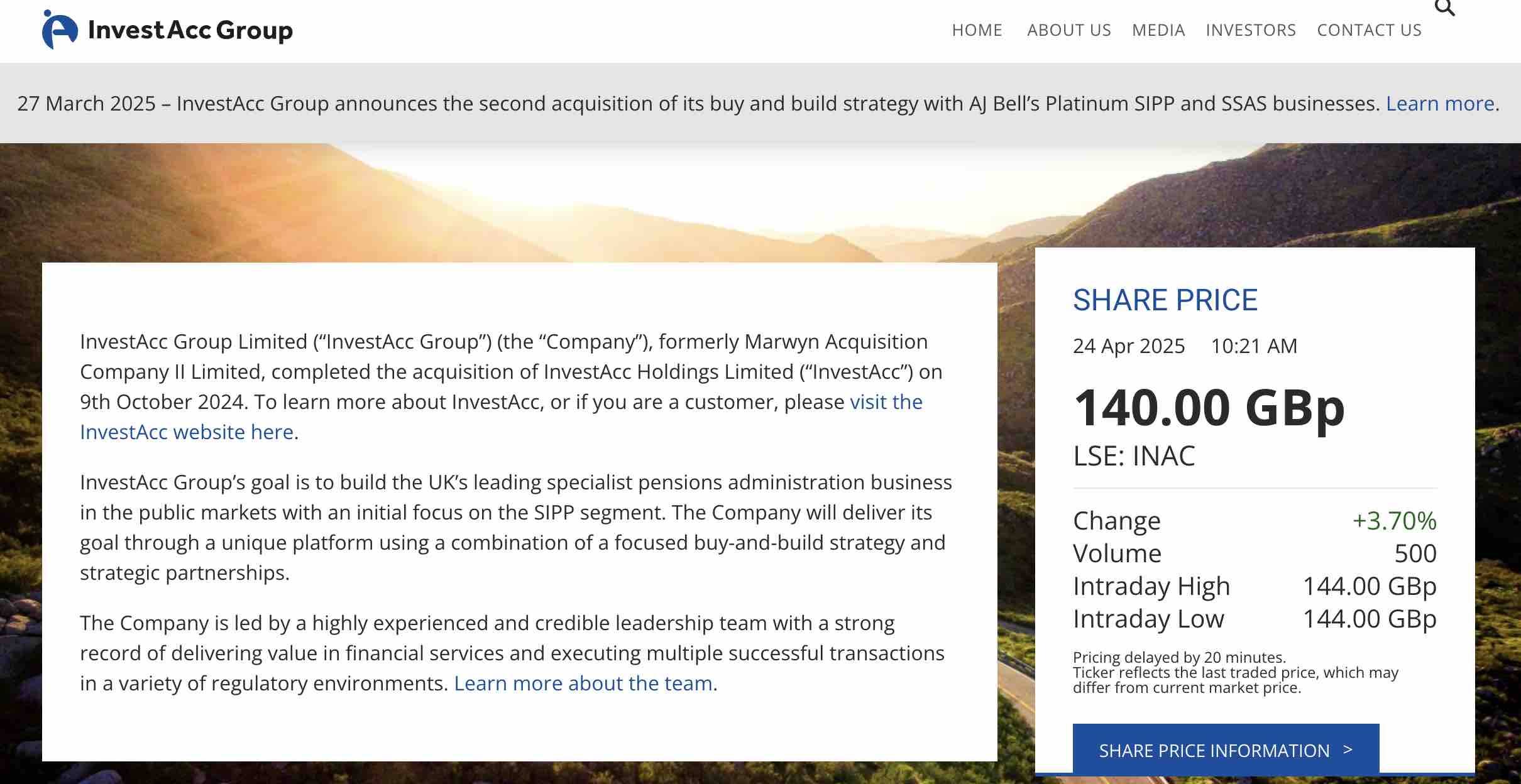

The company, formerly known as Marwyn Acquisition Company, changed its name to InvestAcc last October after acquiring a pensions administration business in a £41.5m deal.

In today’s results InvestAcc said the deal is expected to provide it with over 3,400 pension schemes and £3.3bn of assets under administration.

AJ Bell Platinum has £3.2bn in assets under administration on behalf of 3,600 customers. The arm administrates 3,562 schemes with an average account size of around £670,000.

The Platinum business is the high-net-worth arm of AJ Bell’s non-platform SIPP and SSAS business, and in 2024 accounted for around half of AJ Bell’s non-platform SIPP assets.

Mark Hodges, chairman at InvestAcc, said: “The first six months of 2025 have seen continued progress as the group has delivered organic growth alongside the execution of strategic acquisitions and projects.

“The focus of the group during the second half of 2025 will be to continue to deliver customer service excellence and organic growth, implement the next phase of the Treasury Function, complete the acquisition and associated integration activities, and build out group-wide capability and expertise.

“The company is also continuing to pursue its buy and build strategy through targeted acquisitions, with a pipeline of both company and client book extraction opportunities which are under active review.”

InvestAcc Group was formerly known as Marwyn Acquisition Company II Limited. It completed the acquisition of InvestAcc on 9 October 2024 for £41.5m. Its buy-and-build strategy is to build the UK’s leading specialist pensions administration business in the public markets with an initial focus on the SIPP segment.