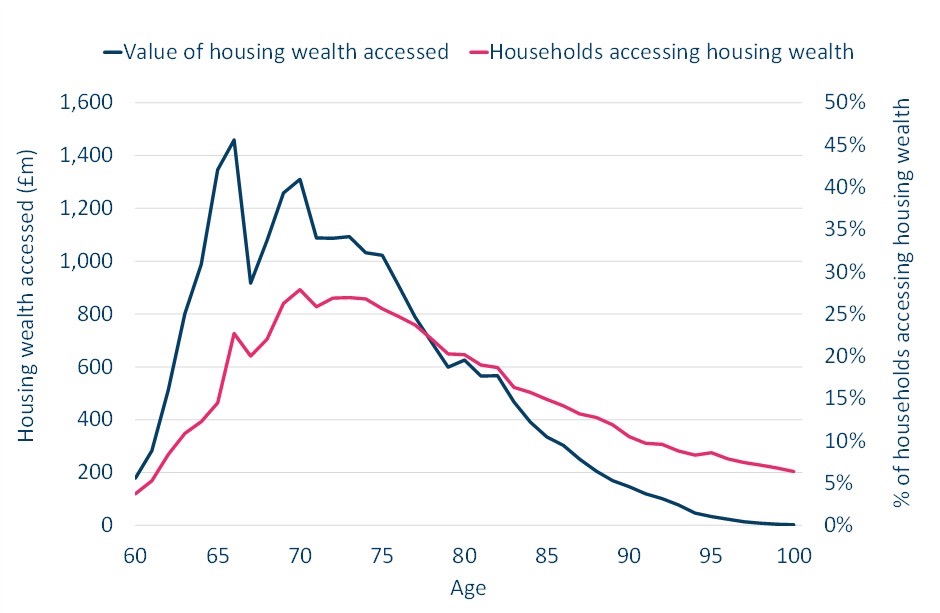

Value of housing wealth accessed, and proportion of households accessing housing wealth by age. Source: Fairer Finance

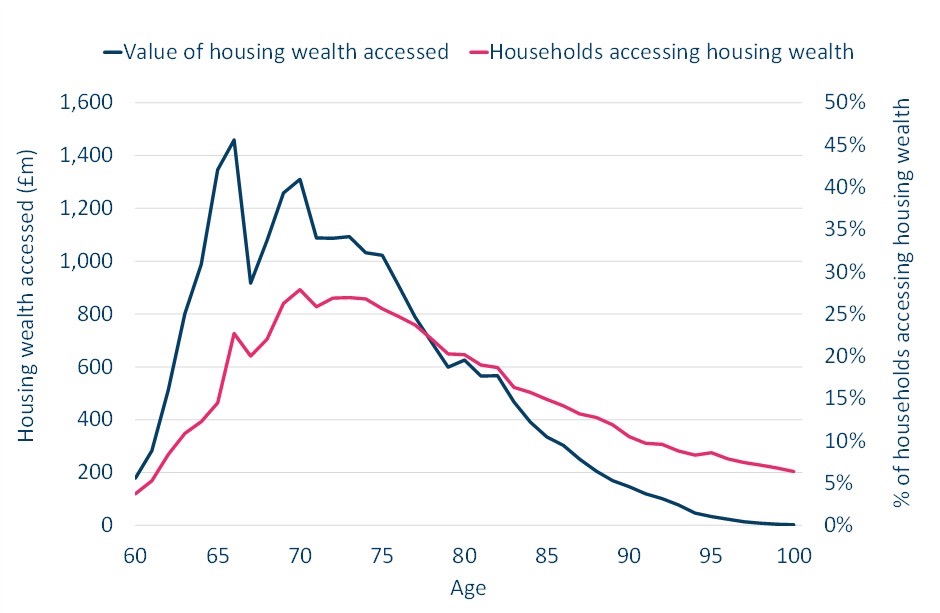

Value of housing wealth accessed, and proportion of households accessing housing wealth by age. Source: Fairer Finance

Just over half of UK households (51%) will need to use property wealth in retirement to maintain a comfortable standard of living, according to a new report.

Consumer lobbying group Fairer Finance says in a new report -How can housing wealth bridge the later life funding gap? - that ‘unlocking’ property wealth for retirement could provide £23bn for households each year by 2040.

Fairer Finance says that without moves to encourage more use of lifetime mortgages and unlocking of property wealth householders will face significantly lower living standards and would be more likely to access means-tested benefits, the group warns.

Based on levels of pensions and savings alone, almost four in ten (38%) future retirees are heading for an income below the recommended minimum living standard (listed in Scottish Widows Retirement Report 2024).

Despite this, on average people in the UK hold more housing wealth than pension wealth, highlighting a "major mismatch" between resources and retirement funding strategies, according to the group.

Based on the group’s modelling, it estimates that by the age of 90, some 51% of households could have accessed housing wealth to meet spending needs at some point since the age of 60. Modelling for the year 2040 suggests that approximately 18% of households aged 60+ might access their housing wealth in that year.

Fairer Finance has used available statistics to model the way in which housing wealth can be used to increase living standards in later life.

It says its model is not a forecast but rather an estimate of what could happen if policymakers, regulators, and industry can overcome the barriers that stand in the way of people accessing the value of their home through lifetime mortgages.

The modelling suggests that the UK population of people aged 60 and above could access approximately £23bn of housing wealth each year, in 2025 prices. This figure is based on the modelled population in 2040 (adjusted for inflation), and considers only meeting the spending needs defined in the model. This figure does not consider the use of housing wealth to meet other needs, such as giving inheritance at a time of the consumer’s choosing.

The housing wealth of those aged 60 is modelled to be approximately £4,300 billion in 2040, so the annual withdrawal would be approximately 0.5% of total housing wealth.

The report says: "Without this spending, these households would have a lower standard of living. For some households, this might also mean that they claim more means-tested benefits."

The report has been developed using 9,720 different household scenarios designed to represent the range of outcomes expected for 75% of the whole population aged 60 and above. These outcomes are aggregated – using weightings based on available statistics – to provide UK-wide totals.

The Report suggests 5 policy recommendations to tackle the issue:

1. Increase housing supply: Build more suitable and desirable homes for downsizing located in the communities where people in later life wish to live.

2. Reduce stamp duty: Cut stamp duty for older people downsizing to encourage mobility and free up larger homes.

3. Normalise the use of housing wealth to maintain living standards in later life: MoneyHelper and Pension Wise should embed housing wealth as a central part of later life advice and guidance. Government and public agencies should invest in public information campaigns to break down the stigma and normalise the use of housing wealth in retirement.

4. Create a single financial view: Government and regulators should develop a personalised service for consumers to see their pension and housing wealth in one place.

5. Reform financial advice: The report calls for the FCA to reform the regulation around later life advice, to break down advice silos and ensure all consumers are supported to maximise the use of all their assets as they approach retirement.

James Daley, managing director at independent consumer group Fairer Finance, said: “It’s an inevitability that more people will need to rely on their housing wealth in retirement – and our new research shows the scale of the problem as well as the opportunity. The combination of smaller pensions, increased longevity and rising care costs threaten to create a perfect storm which will leave millions of people unable to maintain their living standards in later life.

“But with around 75% of the population owning a property as they reach retirement, many people are sitting on – and sleeping in – a significant store of wealth. As things stand, there are a number of social, economic and regulatory barriers which stop housing being part of the mainstream retirement planning conversation. For those who want to downsize, there is a lack of suitable and desirable retirement housing. Whilst when it comes to borrowing in later life, the silos in regulated advice markets mean many people are not being presented with all their options. If we’re to head off a later life funding crisis, policymakers need to start taking action to bring down these barriers now.”

• The report - ‘How can housing wealth bridge the later life funding gap?’- makes five recommendations to regulators and government: