Treasury HQ

Inheritance tax receipts for April and May 2025 hit £1.5bn, a £98m rise on the same period last year.

That’s an increase of 7% on the same month of 2024, according to the HMRC data.

The OBR’s most recent forecast, published at the Spring Statement, projects another record year with IHT predicted to generate £9.1bn in 2025/26 and revenues are expected to raise more than £14bn by 2029/30.

The amount has been soaring as nil-rate bands remain frozen. The current £325,000 nil rate band has been at that level since 2009.

The residential nil rate band was introduced on a phased basis between 2017 and 2020 and potentially gives an additional £175,000 nil rate

band (making a total of £500,000) subject to certain rules.

Stephen Lowe, director at retirement specialist Just Group, said: “The Treasury’s IHT revenues continue to surge with this tax train showing absolutely no signs of running out of steam through the first couple of months in this financial year.”

“Over the past four years, rising asset prices and frozen thresholds have combined in a pincer movement to drive consecutive record annual totals. The reforms announced at the Autumn Budget 2024, which included further extending the threshold freeze and tightening the exemptions for pension wealth, will likely tip more estates into paying the tax and further boost the Chancellor’s coffers.”

|

Tax year |

IHT receipts (£bn) |

|

2020/21 |

5.3 |

|

2021/22 |

6.1 |

|

2022/23 |

7.1 |

|

2023/24 |

7.5 |

|

2024/25 |

8.2 |

|

2025/26 (2 months) |

1.5 |

Andrew Tully, technical services director at Nucleus said: “IHT receipts have increased more than 50% over the past five years with the OBR suggesting significant increases will continue over the next few years.

“Receipts will increase further in the years to come due to recent policy changes including limits to agricultural and business reliefs and extending the freeze in IHT nil-rate bands to 2029/30, as well as ongoing increases to property prices across the UK. If the Government’s proposals to include pensions within the estate for IHT purposes from April 2027 are introduced that will drive further strong growth.”

He said the changes are likely to make IHT a more relevant issue for many more families within the next five years. “Advisers can help clients mitigate these taxes by setting up trusts and making use of gift allowances and the spousal exemption.”

Ian Dyall, head of estate planning at Financial Planner Evelyn Partners, said: “One way to mitigate IHT is through lifetime gifting, something clients are increasingly approaching us about in a bid to protect their beneficiaries from tax. Making regular gifts using the ‘normal expenditure out of surplus income’ exemption is one popular option, as is exploring longer-term gifting plan, such as starting the ‘seven-year clock’ ticking on larger gifts.”

He warned that how long clients can take advantage of these options remains to be seen. “The Government may choose to overhaul the gifting regime at some point, potentially extending the seven-year rule to 10 years – a move that would create an extra hurdle for those wanting to pass on wealth in a tax-efficient way.”

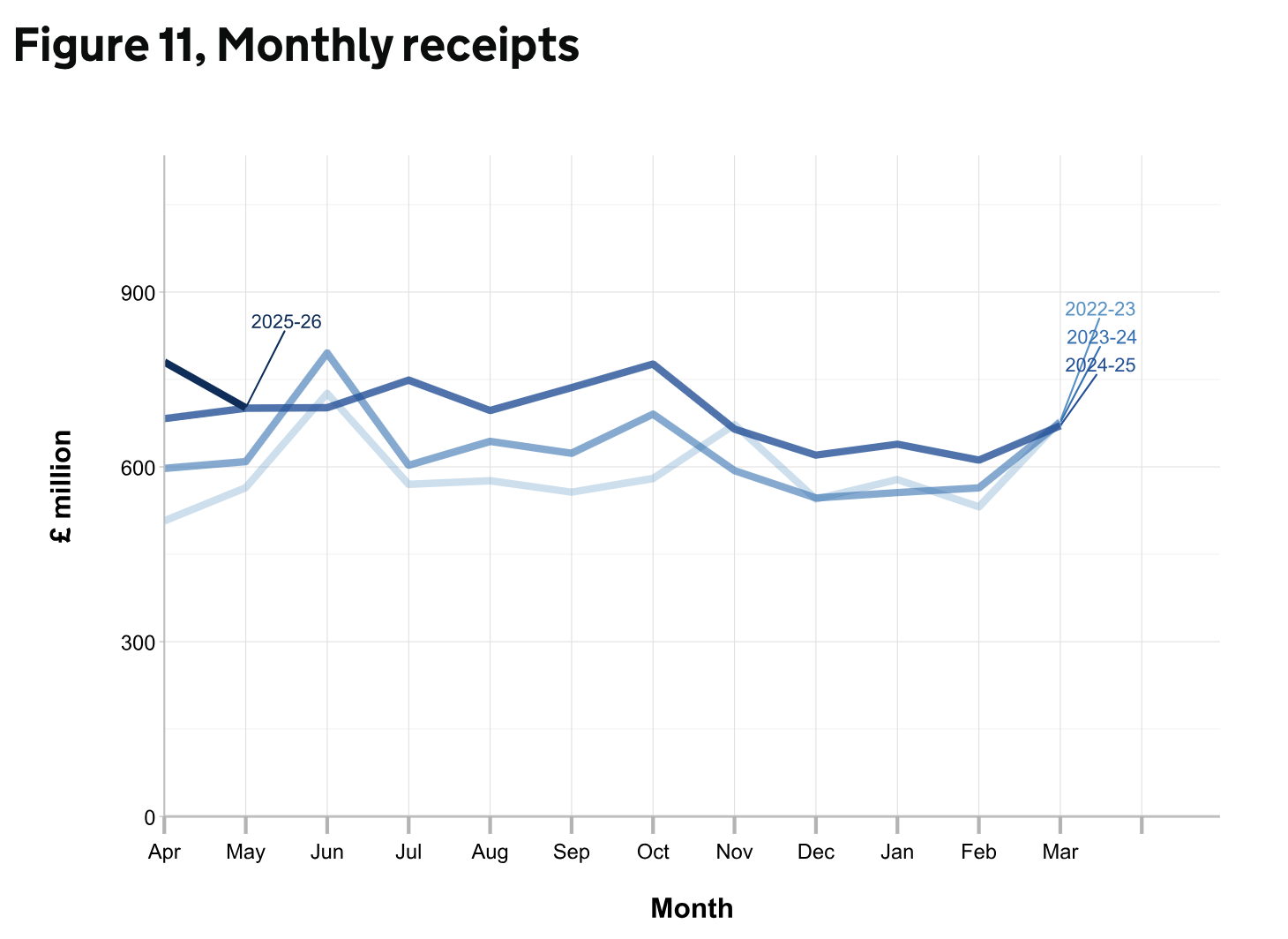

Figure 11 above (source: HMRC) contains the monthly receipts patterns in each financial year since 2022 to 2023 and shows higher receipts from March 2022 are expected to be due to a combination of higher volumes of wealth transfers following recent liable deaths, recent rises in asset values, and the government’s March 2021 and Autumn 2022 decisions to maintain the tax free thresholds at their 2020 to 2021 levels up to and including 2029 to 2030.