Football clubs may become FCA-regulated after the regulator signed a Memorandum of Understanding (MoU) agreement with the new Independent Football Regulator (IFR).

There are now an estimated 39.1m income taxpayers, up 6.1m from when thresholds were frozen in 2021/22, according to analysis of HMRC figures.

One in four (25%) of all article 8 funds remain at risk of greenwashing, according to a new report, which suggests that the risk is stabilising.

Fund manager Fidelity International is launching a new range of globally diversified model portfolios which it says are designed to give advisers greater flexibility in meeting evolving client needs.

Wealth manager and Financial Planner Brooks Macdonald said its total funds under management and advice (FUMA) climbed by 5% to £20.1bn in the last six months, up from £19.1bn at the end of June 2025.

Workplace pension scheme Nest has launched a campaign to show pension savers how their savings are being invested in local projects.

The Chartered Institute for Securities & Investment (CISI), the professional body which awards the Certified Financial Planner qualification, has awarded three new Honorary Fellowships to veteran financial services professionals.

Wealth manager and Financial Planning firm Evelyn Partners has appointed directors in Financial Planning to its London and Cheshire offices.

The average stocks & shares ISA fund has enjoyed growth of 11.22% over the past 12 months, more than three times the average return offered by a cash ISA.

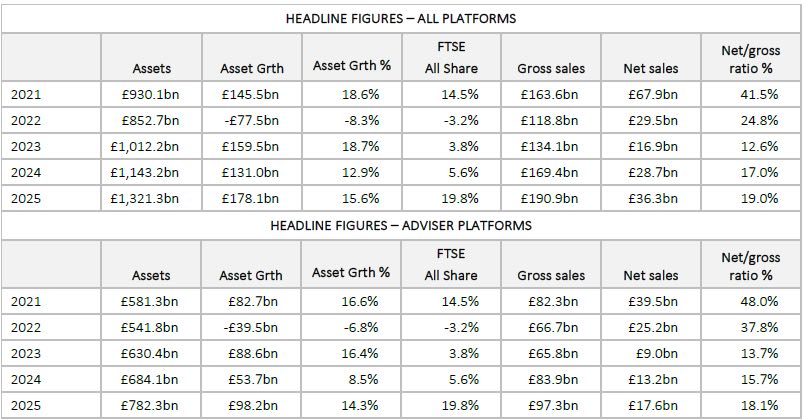

Platform assets reached a record high in 2025 hitting £1.3trn, recording the largest single-year gain in the industry’s history, at £178bn.