A wealth adviser firm reckons that 35% of its HNW clients are actively considering relocating to a lower-tax country.

Azets Wealth Management in Bristol has appointed Financial Planner Simon Stygall as a Chartered Financial Planner and director.

Life and pensions business Chesnara has agreed to acquire Luxembourg-based closed life insurance business Scottish Widows Europe from Lloyds Bank subsidiary Scottish Widows for €110m (£95.98m).

Fintech and investment provider Timeline has linked with research platform Mabel Insights to enhance adviser access to portfolio solutions, it said.

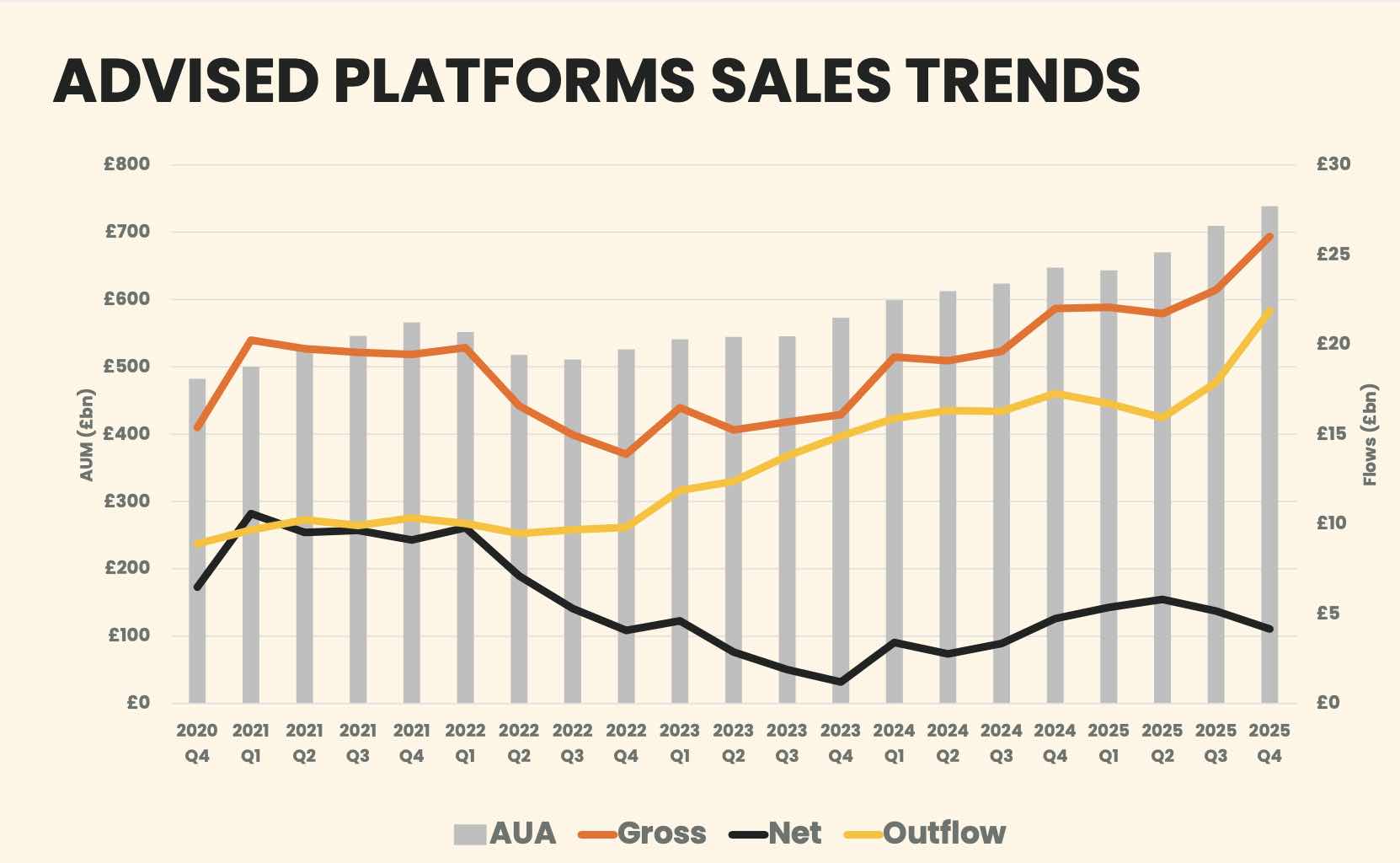

There were record gross sales and outflows for advised platforms in the last quarter of 2025.

The Quilter Foundation, the charity arm of wealth manager Quilter, has pledged £3m to financial education over the next five years.

Total sales growth at Canada Life UK in 2025 climbed 17% to £5.2bn, the firm revealed in annual results published today.

Only a fifth, 19%, of people would seek financial advice from a professional financial adviser despite less than half (46%) saying they felt financially secure.

Aegon has launched new Junior ISA with no annual charge until age 18.

A Financial Planning firm based in Ellesmere Port, Merseyside, has failed after a claim against the firm was upheld this week by the Financial Services Compensation Scheme.