The Chartered Insurance Institute (CII), professional body and parent of the Professional Finance Society, has seen a continued increase in the total number of qualifications completed in 2025.

Sir Jan du Plessis is to step down from the Financial Reporting Council (FRC) at the end of September having served as Chair for the last four years.

While half (46%) of Britons say they feel financially secure, only 11% meet the benchmarks for true financial security, according to a new report.

The Financial Conduct Authority (FCA) has fined two insider dealers a combined £108,731 for insider dealing in shares of Bidstack Group Plc.

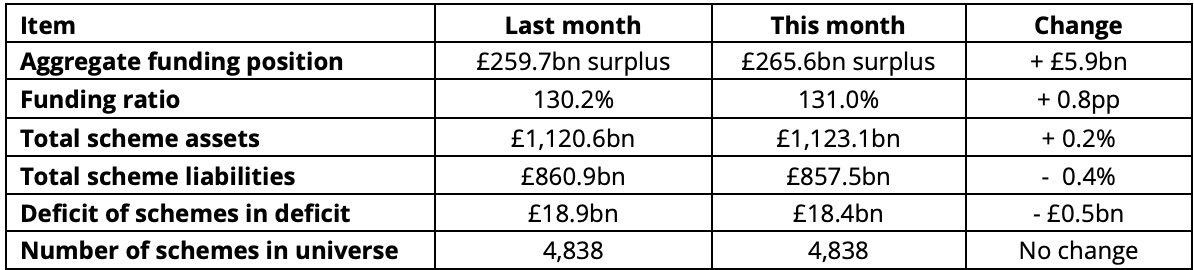

The aggregate surplus of DB pension schemes climbed to £265.6bn at the end of January, according to the latest Pension Protection Fund (PPF) 7800 Index.

There’s been a 14% decline in UK retail investment advice firm numbers over the past two years, according to new analysis of official data.

Aviva was the most recommended adviser platform in 2025, followed closely by Quilter, according to a new report.

The Society of Pension Professionals has called on the FCA to introduce guidance or caps on future growth assumptions, when it launches its new digital pension rules.

Adviser software provider Intelliflo has launched an AI-driven intelligent engagement assistant known as Intelliflo IQ, which it claims will transform adviser efficiency and client engagement.

The Chartered Insurance Institute (CII) and Personal Finance Society (PFS) have opened entries for the 2026 Apprenticeship Awards, the fourth annual celebration of apprentices and supporting employers.