DWP says gender pension gap is 35%

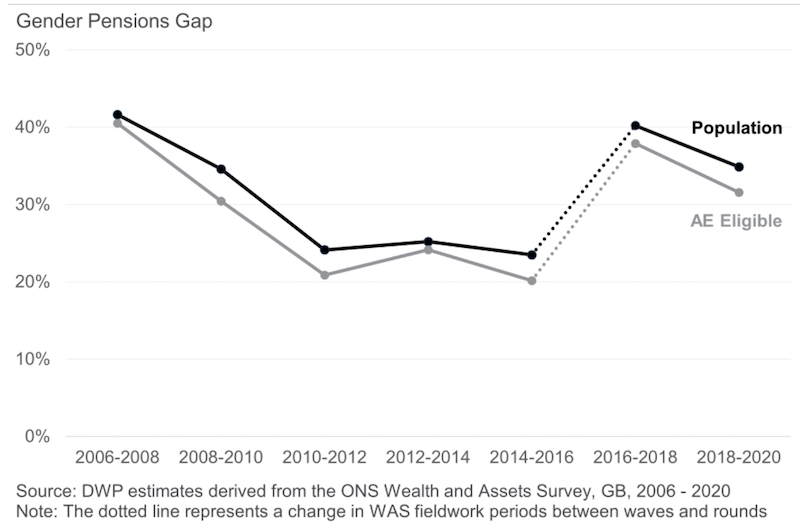

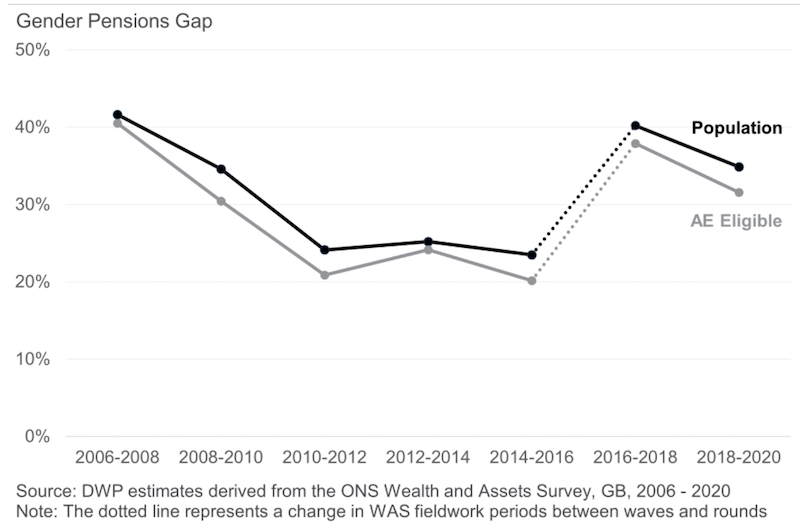

New data published today by the Department for Work & Pensions shows the gender pension gap stood at 35% for the period between 2018-2020.

That was a slight decrease on the previous level of almost 40% recorded in 2016-2018.

When considering only those who are eligible for automatic enrolment, the gap is smaller and stood at 32%, the figures showed. The gap varies for different age bands and is lowest for people in their thirties.

The gap is smallest for those aged 35-39 (10%) and then increases to 47% for those aged 45-49. The gender pensions gap then decreases again in the later years of working life.

Gail Izat, workplace managing director at Standard Life said: “The gender pension gap is still way too high – we simply shouldn’t still be seeing such a huge discrepancy between men and women’s retirement savings as we move towards the mid 2020s.”

She said the gender pay gap is a major contributing factor, as well as the fact that women are more than three times as likely as men to work part time, often as a result of taking on the majority of caring responsibilities within a family.

Ms Izat said: “These issues might be beyond the scope of the pensions world, but there are structural changes that could be made within the UK pensions model to help close the gap. Removal of the lower earnings threshold so people start contributions from the first pound of earnings would be a good start, as a higher proportion of female than male workers fall below the current £10,000 starting position.”

Laura Myers, a member of LCP’s gender pension gap working group, said: “The publication of these statistics represents a vital first step in tackling profound gender inequalities in pensions, and Laura Trott is to be commended for getting this work done within months of coming into office.

“Not only does this report put the issue firmly on the government’s agenda, but it means we will be able to hold governments to account to make sure that progress is made on the yawning gap in pension rights between men and women.

"Although good progress has been made in recent years in reducing the gender gap in state pensions, the gap in DC pension rights between men and women is steadily growing, and risks replicating the inequalities we saw in the Defined Benefit world.”

Between 2010 and 2016 the gap was nearer 20%, which the DWP says was because: “Female uncrystallised private pension wealth at normal minimum pension age increased at a higher rate compared to equivalent male pension wealth. Therefore, the gender pensions gap decreased across this period.”

From Financial Planning Jobs. For more click on any job.

-

Financial Planner - home based/UK wide - £60k+

Financial Planning Jobs Read more... -

Financial Adviser - London/South East - To £70k

Financial Planning Jobs Read more... -

Senior Financial Adviser - £65k-£75k - Bucks

Financial Planning Jobs Read more...

This is a selection of jobs from our new Financial Planning Jobs site - for more job vacancies click on any job or the link below.

Financial Planning Jobs https://jobs.financialplanningtoday.co.uk/