LCO partner Steve Webb

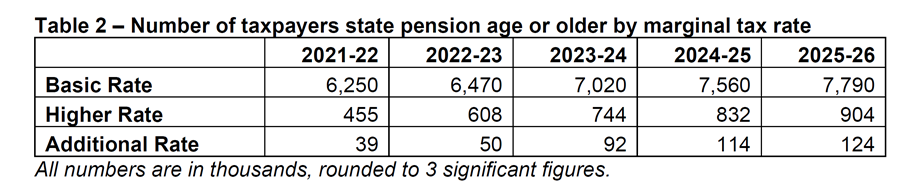

The number of pensioners paying higher rate tax at 40% or 45% has doubled to a million in the last four years.

Four years ago only half a million pensioners paid higher rate taxes.

Nearly 9m pensioners now pay income tax.

In a little-noticed knock-on effect of fiscal drag, these pensioners will also pay extra tax on their savings income and capital gains, according to former Pension Minister Steve Webb.

He warned: “The higher rate threshold has become a real cliff-edge over which growing numbers of pensioners are falling.”

The LCP partner, a former Pensions Minister, obtained the figures from HMRC through an Freedom Of Information request.

Sir Steve said: “There has been a significant increase in the number of pensioners paying income tax at all rates, but the rise has been greatest in the numbers paying income tax at the higher rates.”

He said: “Not only does this mean more tax on things like income from state and company pensions, it also means these pensioners are paying more tax on their savings, as their personal savings allowance is cut, and a higher rate of capital gains tax – a ‘triple whammy’.”

The key figures revealed by the FOI request are:

The main reasons for the increase, according to Sir Steve, are:

Mr Webb warned: “What is not commonly noted is that being a higher rate taxpayer – even by just £1 – triggers higher rates of tax on other forms of income.”