Revealed: ‘Staggering’ rise in auto-enrolment fines

A ‘staggering’ rise has been revealed this morning in the number of auto-enrolment fines handed out.

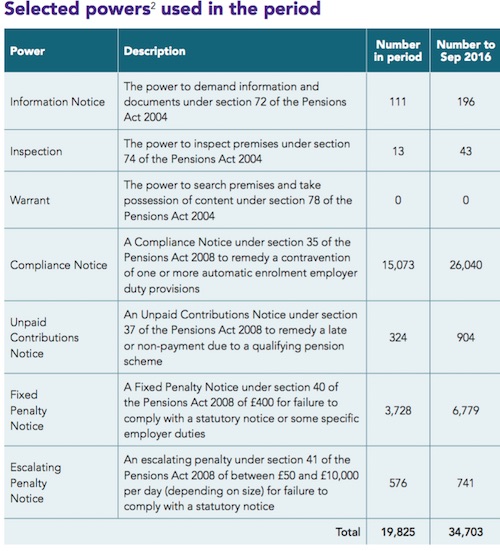

The Pensions Regulator published new data today showing a significant rise in penalties handed out to small and micro businesses for non-compliance in the third quarter of 2016.

There were 15,073 compliance notices in the quarter, 3,728 fixed penalty notices and 576 escalating penalty notices.

See figures in graphic below for more.

Catherine Pinkney, co-founder of the payroll and workplace pension platform, Paycircle, said: “The rise in the number of fixed and escalating penalty notices handed out during the latest quarter is frankly staggering.

"An increase in the number of fines was always on the cards as the smallest businesses started to stage but these numbers are a real cause for concern.”

The regulator stated: “Between July and September this year, we’ve had to use our powers more often, as increasing numbers of small and micro employers reach their staging date and leave it to the last minute to prepare. Although the number of Compliance Notices has risen to over 26,000, we find the majority of employers subsequently comply when given this ‘nudge’ to remind them of their duties.

“Our use of Escalating Penalty Notices has also increased – however, this is a very small proportion relative to the number of Compliance Notices, or to the number of employers staging.

“Less than 5% of Compliance Notices progress to an Escalating Penalty Notice, which demonstrates that our approach of educating and enabling before enforcing is both effective and proportionate.”

Miss Pinkney said: “Between now and 2018 over a million small businesses are set to stage and, judging by this data, the number of fines is set to skyrocket.

"This latest data from the regulator is proof positive that too many small businesses are still in the dark about their workplace pension duties.

“For a multitude of reasons, not least considerable confusion around whose responsibility the workplace pension is — payroll provider, accountant, bookkeeper, adviser or employers themselves — many firms are burying their heads in the sand.

“Many of the smallest businesses still don't know who to turn to for help. The irony is that for many, doing it themselves can be the quickest and cheapest option.

“The message is still not getting out to smaller business owners that they can set up a fully compliant workplace pension scheme themselves at no cost, and in some cases in as little as an hour."