A new £49 robo-advice service with a free guidance report is set to be launched.

The scrapping of the 25% tax free lump sum would be a “major blow” to savers, a pensions firm director has warned ahead of next month’s Budget.

Consumers are prepared to use robo-advice to invest up to £1,000 of their savings but less than a quarter would trust it to replace a professional adviser.

The advisory firm most complained about to the Financial Ombudsman Service for the last six months of 2015 was Sesame.

The Financial Conduct Authority has fined W H Ireland Limited £1.2million and restricted the firm from taking on new clients in its Corporate Broking Division for 72 days.

A touch-screen Financial Planning tool designed to be used on iPhones has been launched by Voyant UK.

Retirement customers continue to look to invest the tax free cash lump sum from their pension pots into the buy-to-let property market despite the looming tax clampdown, data from Fidelity International suggests.

Consumers need better help understanding what they can do to make the best use of their pensions and how to do it, the Pensions Policy Institute’s deputy director says.

Staff from a wealth management firm are helping to restore unused or discarded hospital equipment to aid over 130,000 people in India.

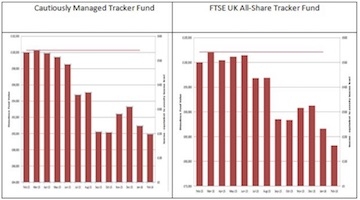

New analysis claims to show the “huge risks” facing people who choose to go into drawdown while at the same time investing their fund for growth, following market turmoil.