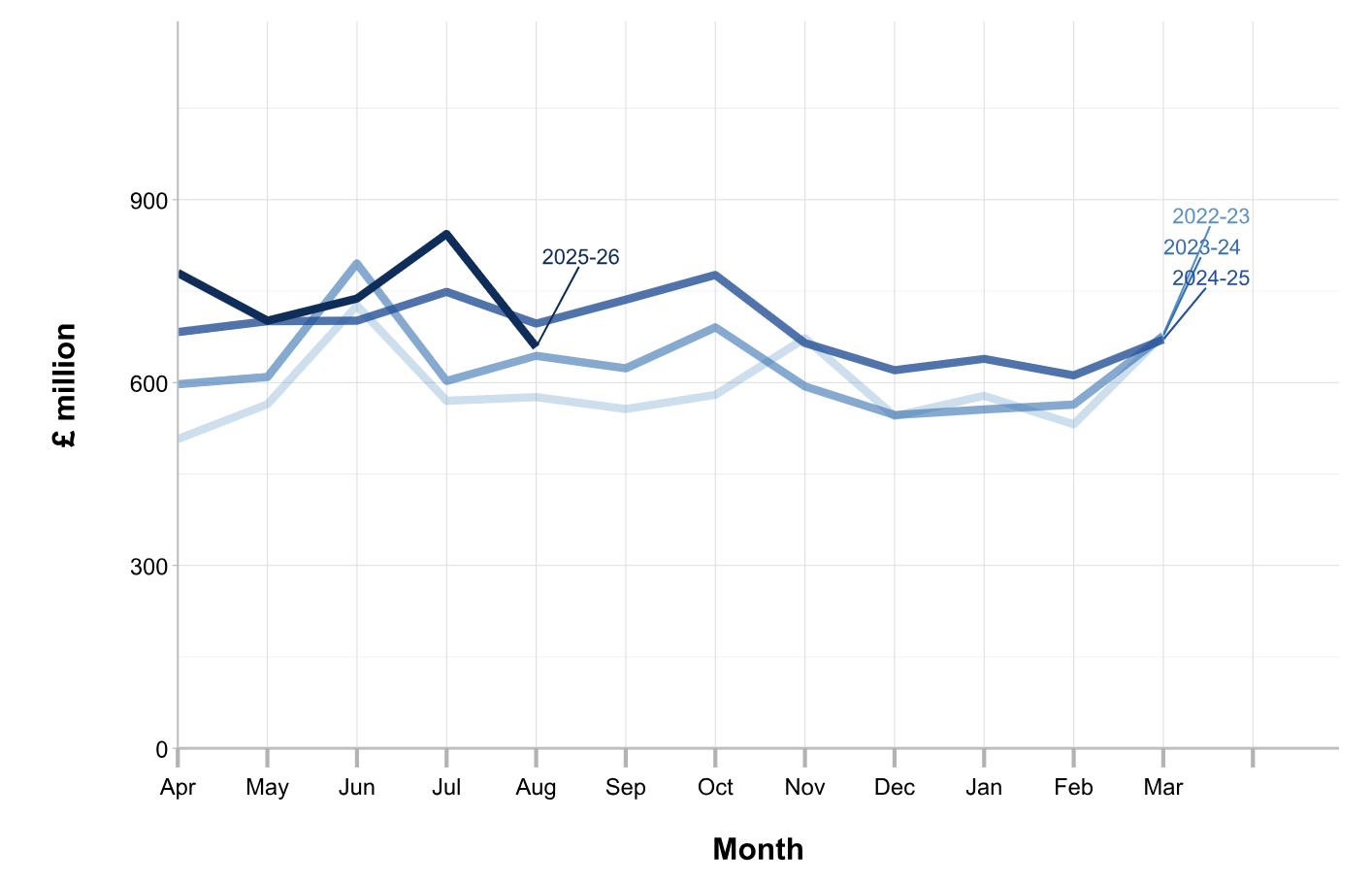

Inheritance tax receipts climbed £200m rising 5.7% in the three months to the end of August, new HMRC data published today revealed.

For April to August IHT receipts were £3.7bn.

That keeps the figure on target to be another record-breaking IHT year, with the OBR’s most recent forecast, predicting IHT will generate £9.1bn for the Treasury in 2025/26.

Last year’s record-breaking year of IHT receipts saw £8.2bn collected through the tax.

Jonathan Halberda, specialist financial adviser at Wesleyan Financial Services, said: “With the Autumn Budget looming, another rise in IHT receipts adds to the pressure on families already bracing for change.

“We’re seeing growing panic, with clients eyeing drastic steps like withdrawing pensions early in a bid to stay ahead of possible tax bills. But these knee-jerk moves can backfire, triggering bigger tax bills or long-term financial pain.”

Ian Dyall, head of estate planning at Evelyn Partners, said: "The continued rise in inheritance tax receipts is the result of ‘fiscal drag’, with a long-standing freeze on the IHT nil-rate bands spanning a period when asset prices have risen. With the NRBs frozen until 2030, raised property values and investment assets are drawing more families into the IHT net—often without them realising it.

“This is before the changes to IHT reliefs announced at the 2024 Budget have come into force – changes that are already reshaping estate planning.”

He warned: "The rise in receipts is not just a fiscal story, it’s a wake-up call. Many households are sleepwalking into substantial tax bills.”

Monthly IHT receipts. source: HMRC

Stephen Lowe, director at retirement specialist Just Group, said: “As the Chancellor continues to feel the fiscal pressure, and having ruled out hikes on major taxes, she will want to explore all her options to raise revenue. Given inheritance tax targets those who are wealthiest in society it’s entirely possible that it will once more be in the Chancellor’s sights.”

Nicholas Hyett, investment manager at Wealth Club said: “As things stand inheritance tax may only affect around 1 in 20 estates, but that number is on the increase as an ever greater number of estates become liable for the most hated of taxes. Years of freezes in thresholds, matched with increasing house prices and rising inflation have pushed more families, who might not consider themselves to be wealthy and would not historically have qualified for the tax, over the threshold.”

The current inheritance tax allowance has been frozen at £325,000 for 16 years, and remains frozen until 2030. The £175,000 residence nil rate band hasn’t changed since 2020.