Low income groups are being hardest hit by deteriorating household finances, according to Markit.

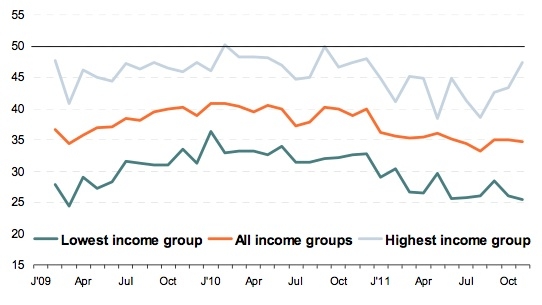

The Markit Household Finance Index showed there is currently the highest disparity ever between the highest and lowest income groups.

Markit is a financial information services company whose Household Finance Index anticipates changing consumers behaviour. The index is currently rated at 34.6, where any rating less than 50 indicates worsening household finances.

In the lowest income group, those earning less than £15,000 per year, over half of respondents reported worsening finances.

The current index rating for the lowest income group was only 25.5, the lowest since March 2009.

In contrast, only 19 per cent of respondents in the highest income group, above £57,751 per year, reported deterioration. Some 14 per cent even saw an improvement in their finances, compared to only two per cent of the lowest income group.

The index rating for the highest income group was 47.3.

High earners also reported seeing savings rise at the sharpest rate since September 2010.

Some 48 per cent of people expect their situation to worsen in the year ahead but, unsurprisingly, those in the highest income group were the least worried about their finances.

Tim Moore, senior economist at Markit, said: “While all eyes are on whether the UK economy will double-dip, the latest survey is a timely reminder that the household recession hasn’t even paused for breath.

“Scratching below the surface illuminates uneven strains across household income categories. Most starkly, the overall figure masks the survey’s widest ever divergence between the financial situation of the top and bottom income groups.”