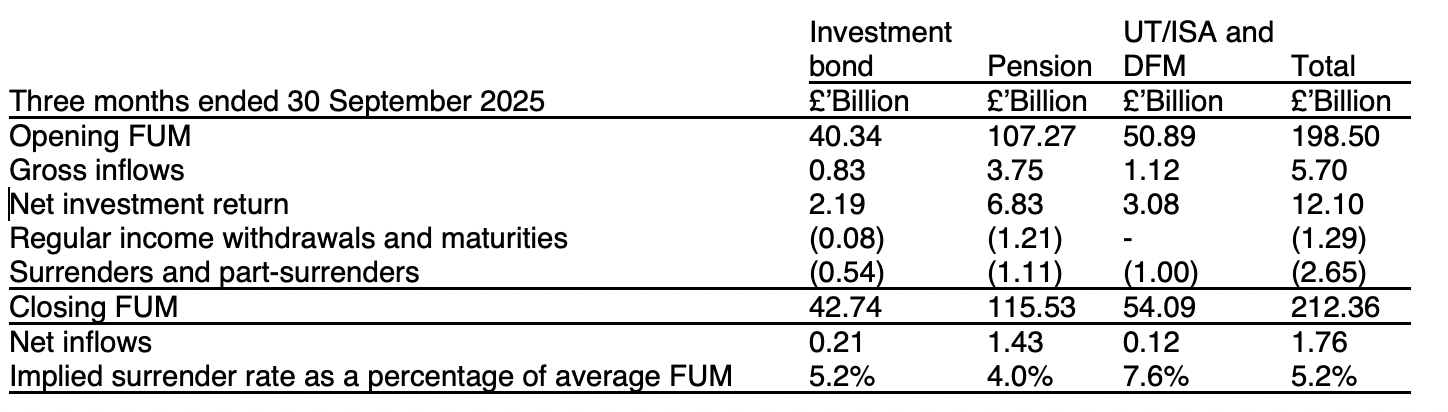

Wealth manager St James’s Place has reported that funds under management have topped £200bn in assets for the first time, climbing 12% in the year to date to reach £212.39bn.

Net inflows were £1.8bn over the three months to the end of September, nearly double the £890m reported in the same quarter in 2024.

Funds under management retention rate for the year to date improved to 95.2% compared to 94.6% in 2024, according to a quarterly trading update from the wealth manager published today.

Mark FitzPatrick, chief executive officer, said: “Gross inflows for the third quarter were £5.7bn, up 30% on Q3 2024, reflecting both strong demand for financial advice and high levels of client engagement and activity ahead of the implementation of our new simple, comparable charging structure in late August.”

Former Prudential group CEO Mark FitzPatrick joined the firm in December 2023 and has spent his time since then trying to turn the company around through a £500m cost-cutting programme and an overhaul of its fund range and charges.

He said: “We were pleased to implement our new simple, comparable charging structure over the August bank holiday weekend, bringing to a close almost two years of effort on this significant programme of work. Completion of this programme has unlocked our ability to innovate our investment proposition for the benefit of our clients.”

SJP Funds Under Management

Source: SJP quarterly trading update

Looking ahead he said the macroeconomic environment presents a more uncertain picture for UK consumers amid soft economic growth, stubborn inflation and heightened speculation around the forthcoming Autumn Budget.

Mr FitzPatrick said: “Against this background, our advisers remain focused on supporting and guiding clients so that they continue making the right long-term decisions to secure their financial futures. This builds trust and strengthens relationships, underpinning our long-term success.”

But he warned that with the third quarter having benefited from unseasonally high levels of client engagement and activity, and with the consumer environment uncertain, flows in the final quarter may be less strong by comparison.