The FCA has cancelled the part 4A regulatory permissions of Glasgow-based firm LR Kennedy Insurance Services (FRN: 311420) after repeated failures from the firm to respond to questionnaires, telephone calls and emails from the regulator.

Campbell & Associates Independent Financial Advice Ltd (FRN: 602550) has been placed under investigation by the Financial Services Compensation Scheme, after its sole director was charged with a £2.3m against involving clients.

Salford-based financial and professional services firm Frenkel Topping has reported record funds under management (FUM) of £1.56bn at the end of 2024, compared to £1.335bn in 2023.

The FCA is embracing technology to help it be more “user-friendly” by reducing regulatory burdens and adopting a more dynamic approach to supervision and authorisation.

Former professional rugby player and Chartered Financial Planner Jason Baggott will jointly lead Scottish wealth manager Tweed’s new sports division.

Average defined benefit pension values have fallen to their lowest rates since the XPS Group’s Transfer Watch was established in 2018.

Financial advice firms fully embracing technology generate more revenue and have more assets under advice and clients than low adoption rivals.

Colchester-based financial advisers Mr G and Mrs P Speller - trading as Solutions Financial Services (FRN 457106) - have been declared in default by the Financial Services Compensation scheme 11 years after losing their FCA authorisation.

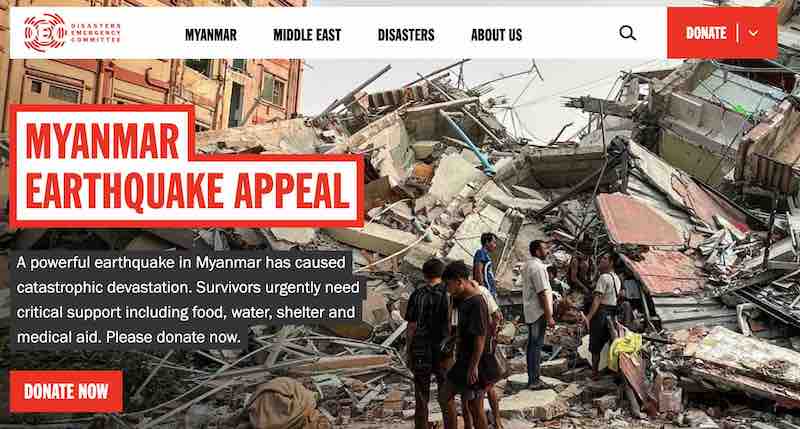

The Quilter Foundation, the charity arm of wealth manager Quilter, has donated £25,000 to the Disasters Emergency Committee Myanmar Earthquake Appeal to support vital humanitarian aid following the earthquake that struck Myanmar last month.

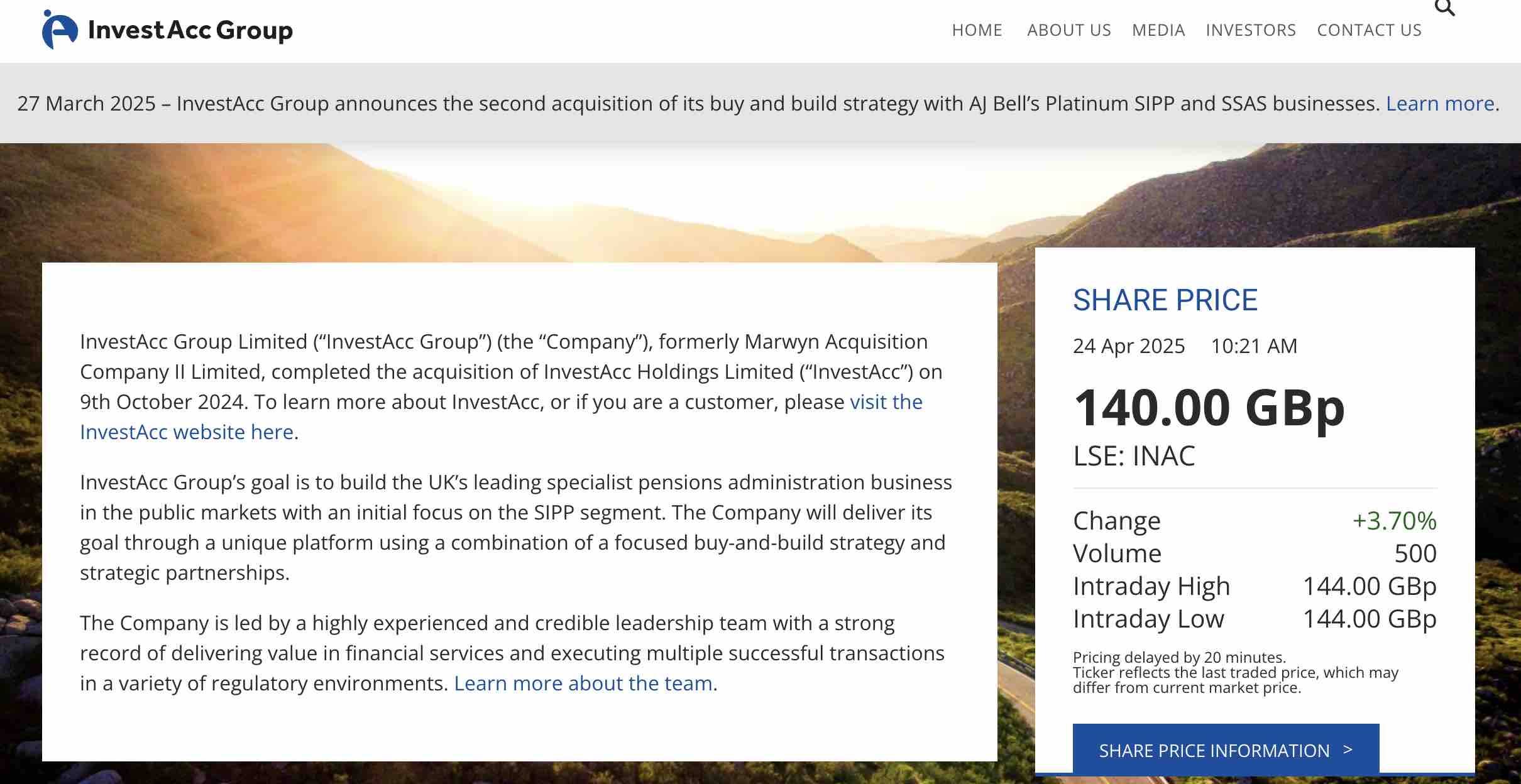

SIPP and SSAS provider InvestAcc has reported revenues increased 16.3% to £10.5m in the six months to the end of December, up from £9m in the same period in 2023.