People living with diabetes can, for the first time, buy life insurance knowing that their premiums will never go up and can go down.

The European Court has ruled in favour of a transgender woman who was denied access to her pension.

Schroders has appointed a former CEO of Tilney as its new global head of wealth management.

Self-employed workers should be offered help with financial advice and flexible pension contribution options, according to national Financial Planning firm LEBC.

Investment research firm Morningstar has announced the winners of its UK Fund Awards 2018.

The annual Morningstar UK Fund Awards recognise the retail funds and fund groups that added the most value for investors within the context of their relevant peer group in the previous year and over longer time periods.

The company says it selected the winners using a “quantitative methodology” and eligible funds needed a five-year performance track record.

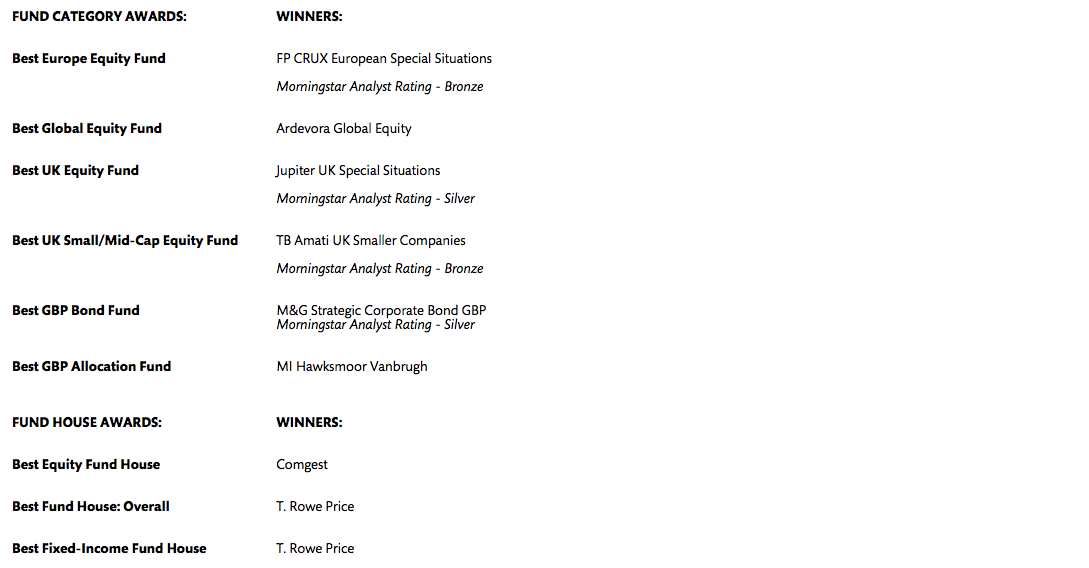

The winners of the Morningstar UK Fund Awards 2018 were:

Jonathan Miller, Morningstar UK’s director of manager research, said: “We saw many strong contenders for the Morningstar UK Fund Awards 2018 and the winning funds and fund houses have demonstrated the ability to earn strong risk-adjusted returns for investors.”

He added: “It’s important for investors to take a long-term view to avoid undue risk.”

The FCA has today thrown down the gauntlet to the industry to help improve access to insurance for those with pre-existing medical conditions.

Selectapension is set to launch a new tool called APTA with a Transfer Value Comparator next month.

Midlands Financial Planning firm Newell Palmer has completed its 50th acquisition with the purchase of Macclesfield-based The Acumen Investment Partnership.

Quilter, formerly Old Mutual Wealth, has floated on the London Stock Exchange today with an initial valuation of £2.8bn.

The administrators of a master trust failed to report their failure to collect or invest nearly £900,000 of auto-enrolment pension contributions on behalf of their members.