Last year 15.8m UK adults who likely needed financial guidance failed to receive regulated financial advice, the FCA has revealed in its new Financial Lives 2024 survey.

The figures showed that 29% of adults that may have needed professional financial advice did not get it in 2024, up from 25% in 2017.

According to the study, people may have needed advice because they had investible assets of £10,000+, and/or DC pension savings of £10,000+ which they were planning to access in the next two years.

People may have needed advice because they had investible assets of £10,000+, and/or DC pension savings of £10,000+ which they are planning to access in the next two years.

They may also have needed advice because they had savings of £10,000+ and planned to retire in the next two years, the FCA said.

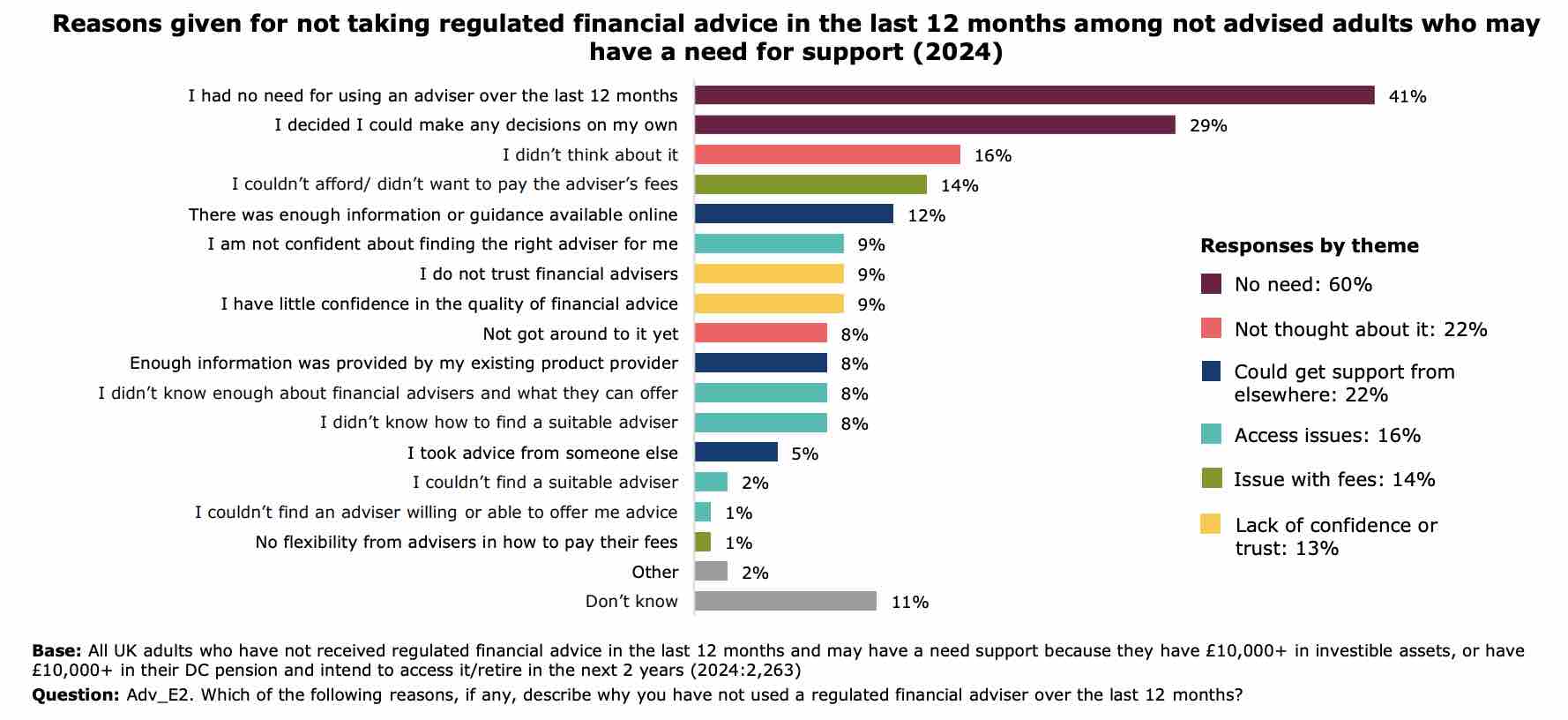

The majority of people who may have needed advice failed to take any because they felt there was no need, according to the research, with 60% selecting that option as applying to them.

A fifth, 22%, said they had not thought about it while a further fifth, 22%, said that they could get support from elsewhere.

Some 16% mentioned access issues, such as they could not find a suitable adviser, while 14% had an issue with fees, mainly that they felt they could not afford adviser fees.

Sine 13% said they did not take any advice because they “do not trust financial advisers” or “have little confidence in the quality of financial advice.”

Source: FCA Financial Lives Survey 2024

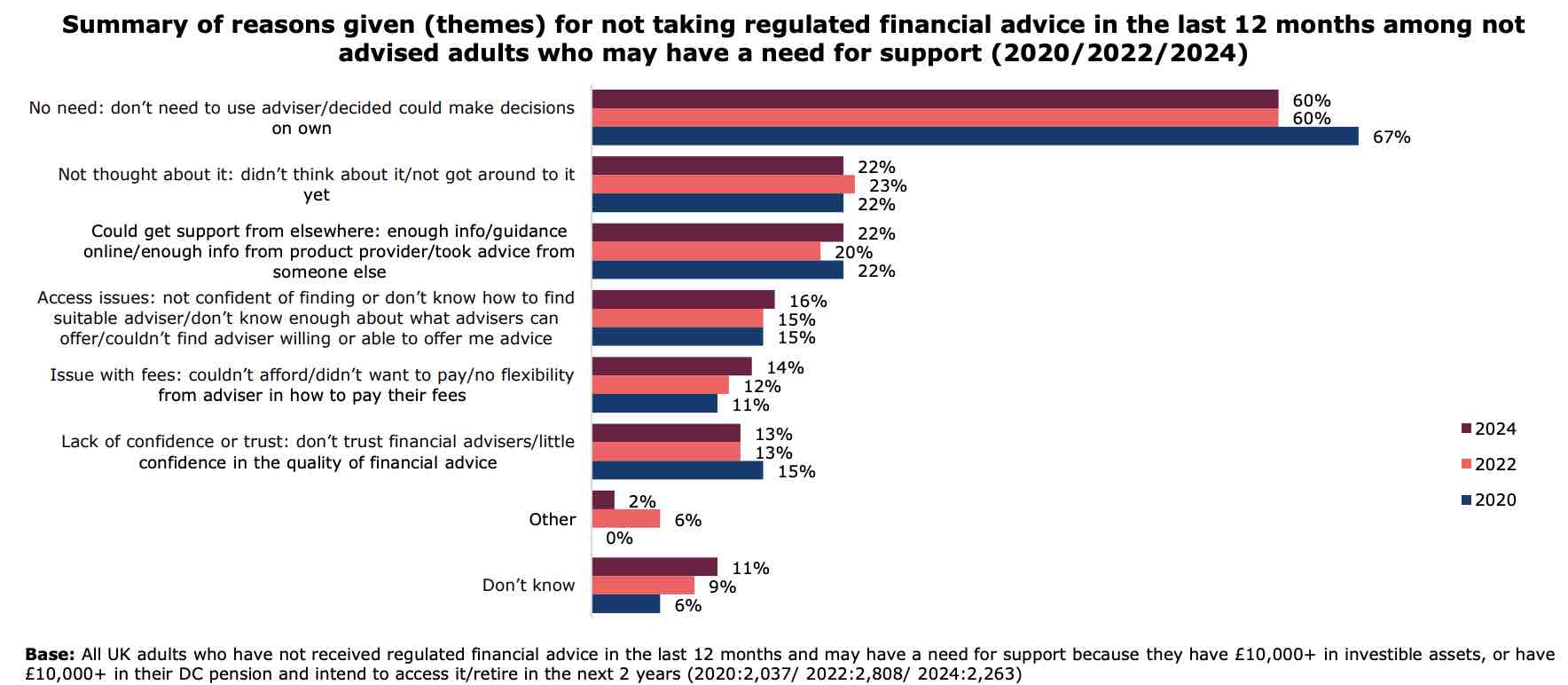

The reasons people gave for not using a financial adviser have changed very little since the FCA’s last surveys in 2020 and 2022.

The number saying they had no need for financial advice was 67% in 2020 and 60% in 2022 and 2024.

The number of people who said they had not thought about it remained fairly consistent at 22% in 2020 and 2024 and 23% in 2022.

There was a similarly consistent number of people who said they felt they could get support from elsewhere, which was 22% in 2020 and 2024 and 20% in 2022.

Access issues also remained consistent at 15% and 16% in the periods, but the number of people having an issue with fees has been rising steadily, from 11% in 2020, to 12% in 2022 and 13% in 2024.

Source: FCA Financial Lives Survey 2024

Elsewhere the study showed that in 2024, while many (68%) 'not-advised adults' who may need support agreed that they would pay for financial advice if the costs were reasonable, relatively few (37%) agreed they had a good understanding of what financial advice costs.

Trust remained a major barrier to seeking advice for some not-advised adults who may have a need for support. In 2024, 24% did not trust financial advisers to act in the best interest of their clients, 39% did not think advisers were unbiased, and 21% did not think of them as professionals, like solicitors and accountants.