Of the 8.8m households in a position to invest, some 42% of them, almost 4m, do not bother, according to new research.

The Hargreaves Lansdown Savings Barometer considers households are ready to invest if they meet three criteria.

They must have enough emergency savings, they must not feel their debts are a burden and they must not be in arrears.

The barometer has been developed in partnership with economic advisory firm Oxford Economics.

The latest report shows that the highest earning 20% of households are most likely to be able to invest, but a large number don’t.

Some 3.2 million households in the group could invest, according to the report, but nearly a third (31%) aren’t currently investing.

At the other end of the scale, 28% of households (2.9m) aren’t in a position to invest – but do so anyway.

The report comes as Chancellor Rachel Reeves is set to do more to encourage people to invest and avoid leaving their savings languishing in low interest rate deposit accounts.

Sarah Coles, head of personal finance, Hargreaves Lansdown, said: “The figures demonstrate how much more needs to be done to build an investment culture in the UK. The sheer size of the investment gap within this group demonstrates the enormous potential for savers to embrace investment.”

She said the figures demonstrate why changes to the advice/guidance boundary will be transformational.

“It will give people the understanding and confidence to realise the right balance of savings and investments for their needs, and take advantage of the huge potential that investment offers,” she said.

Source: Hargreaves Lansdown Savings Barometer

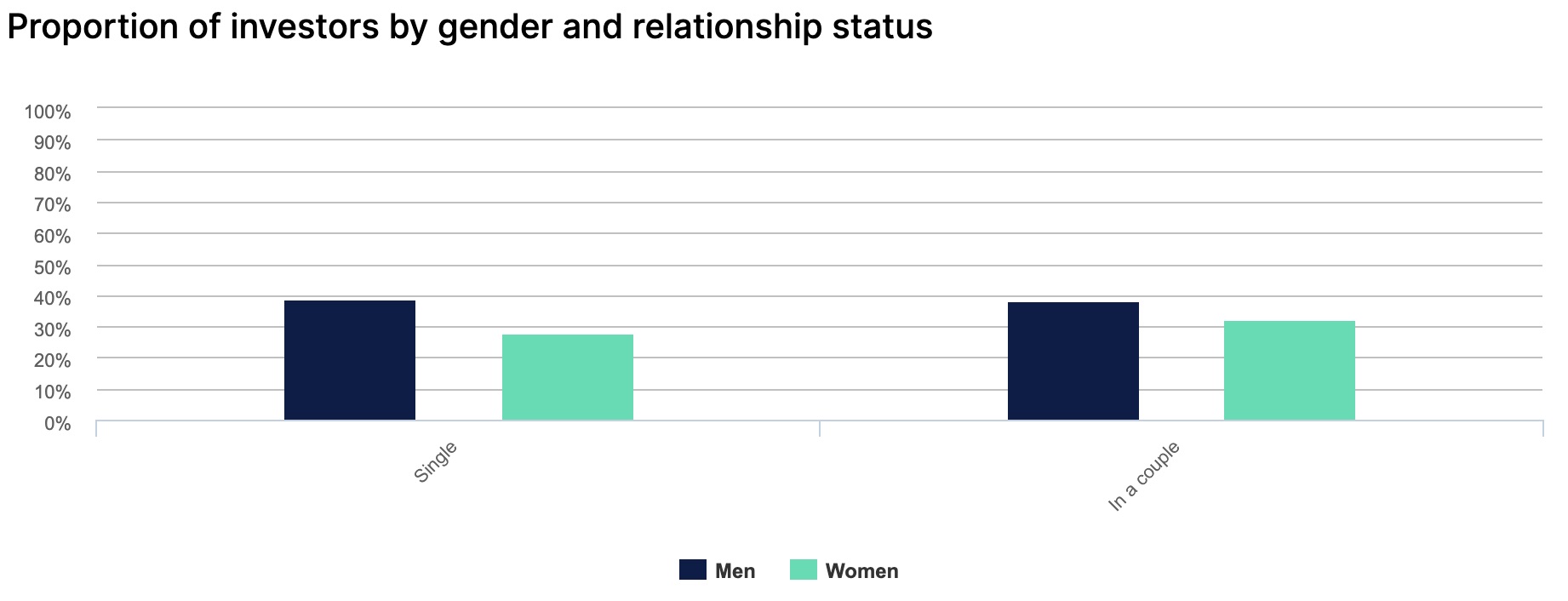

The data also revealed a striking gender investment gap, with only 28% of single women investing compared to 39% of single men. Within relationships the gap narrows, but remains significant, with 32% of women in couples investing and 38% of men.

Ms Coles said: “This owes something to the fact that women tend to be on lower average incomes, and those who earn less tend to invest less. In couples, they share more costs so can free up more for investment.

“However, that’s not all that’s at play, because the gender investment gap opens far earlier than the pay gap. It means more needs to be done to engage women with the enormous difference investment can make to their financial resilience.

The data also showed that only 43% of households have enough pension savings. The highest earning households have the biggest pension adequacy gap - of £64,800, compared to a pension gap of £1,250 among the lowest earners.

Helen Morrissey, head of retirement analysis, Hargreaves Lansdown, said: “We’ve got a mountain to climb when it comes to pension adequacy."