As the owner of a small financial planning practice I have been asking myself how on earth is a small business going to cope with a looming bureaucratic red tape nightmare?

We need more Financial Planners. To be clear, this isn’t some shady attempt at recruitment for my own business. Goodness knows that four of us is enough for now.

Our democracies could use a dose of Life Planning.

It’s all too easy to become distracted by the hysteria of presidents, prime ministers, politics and performance in this busy start to 2017.

Every year there is a warning out to those doing pension transfers that they need to be extra careful if the client may die within two years of the transfer because of ill health at the point of the transfer.

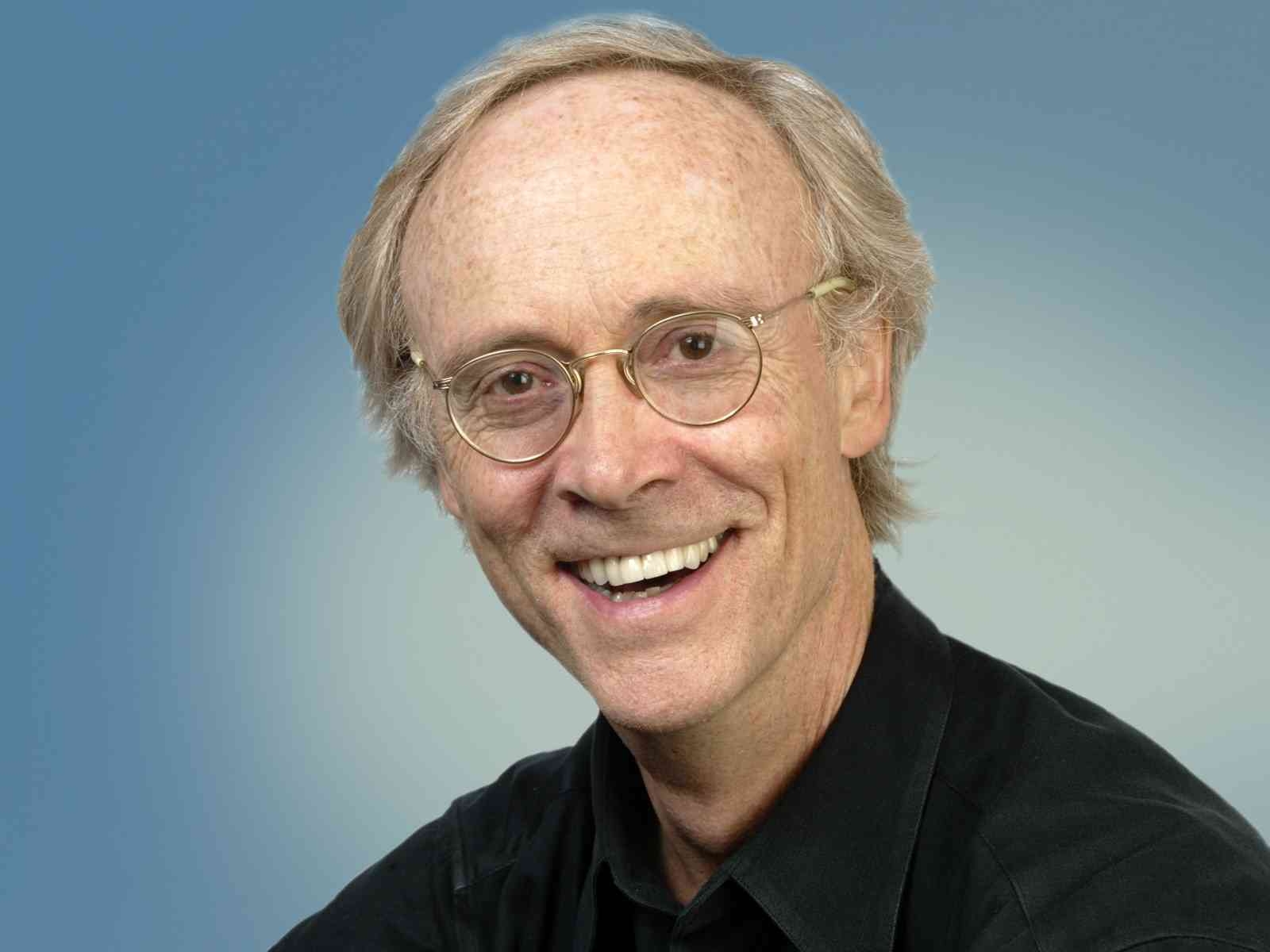

Reading the columns by Kevin O’Donnell and Martin Bamford in recent weeks got me thinking about what I would want to see and what I would want to achieve in 2017.

Editor: My 10 Wishes for Financial Planning in 2017

It’s traditional at this time of year to make predictions about the coming 12 months. Being somewhat of a contrarian I’m not going to do that.

It’s not a merger but it is a step forward for the Chartered adviser bodies and the Financial Planning profession and it’s long overdue.

In the first of her new columns for Financial Planning Today, Chartered Financial Planner Nicola Watts APFS discusses the problem with recruiting Paraplanners with the right skills and experience and explains how fundamental a role she sees them playing in coming years.

It only feels like a moment ago that we entered 2016. Both personally and professionally it's been quite a year.