Pension providers have been urged to find out more about post-retirement spending as new research suggests homeowners’ and renters’ drawdown habits are very different.

It comes ahead of new legislation due to be presented to Parliament which will place a legal duty on providers to offer a ‘default’ post-retirement journey.

The problem for providers is that there is limited evidence regarding the trajectory of pensioner spending in retirement.

The research collaboration between consultants LCP and the University of Bath revealed major differences across the pensioner population.

The ‘Downhill all the way?’ report analysed data on the spending patterns of more than 100,000 pensioners collected over more than half a century as part of annual government surveys of households.

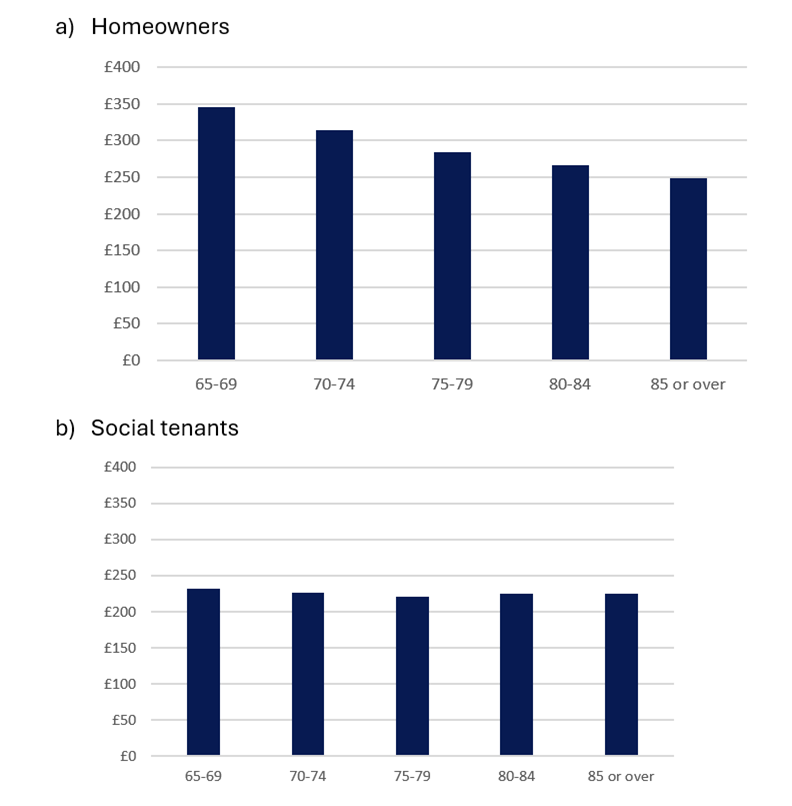

It found that pensioners renting from a social landlord tend to have relatively flat real spending which is relatively low compared to homeowners who tend to frontload their spending on ‘luxuries’, which drops sharply as they get older.

Spending per head (£ per week, 2024 prices) by housing tenure and age (1968-2019)

Source: calculations based on Family Expenditure Survey and successor surveys

The research also found that for most pensioners retiring today with just a DC pension pot, the state pension will provide the majority of income in retirement. Under current legislation the state pension is expected to provide a steady real-terms increase in income through retirement.

Steve Webb, former Pension Minister and partner at consultants LCP, said: “The starting point for designing post-retirement products should be analysis of what pensioners actually spend.

"This data provides startling evidence of the diversity of pensioner preferences and in particular that homeowners strongly prefer to spend more of their retirement wealth in the earlier part of their retirement, whereas renters may want and need a steadier income.

“The more that providers can find out about their savers, the more the post-retirement journey can be tailored to be a good fit for different groups of pensioners.”

Claire Altman, managing director for individual retirement at Standard Life, said: "There is a need for default retirement solutions through guidance for those not taking financial advice, and that these consider the different circumstances facing groups of retirees.

"It is essential that people have the right support to effectively plan not just for the day they retire, but the decades that follow, and this is where role of both the industry and government is of paramount importance.”

• Data drawn from the Family Expenditure Survey, the Expenditure and Food Survey and the Living Costs and Food Survey for the period 1968-2019