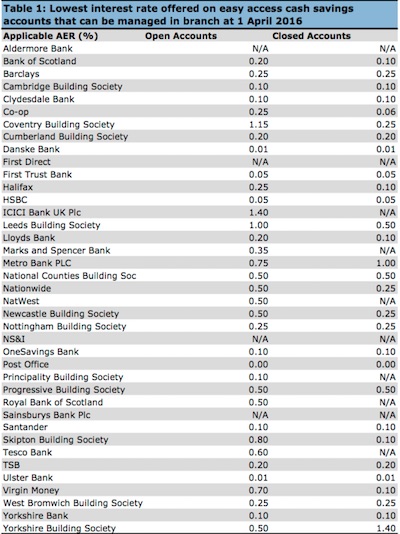

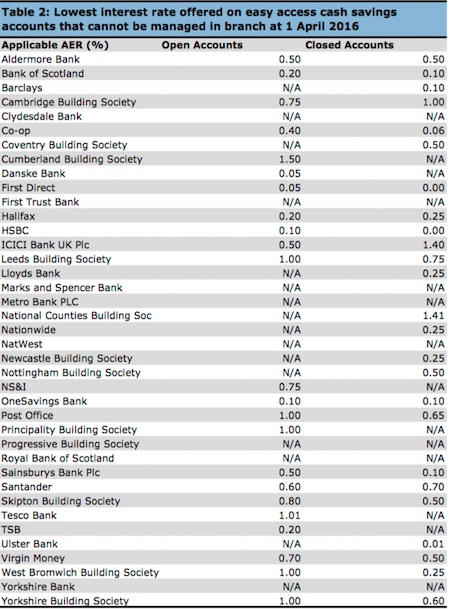

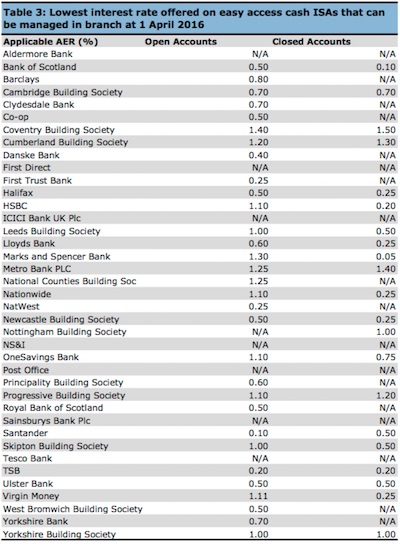

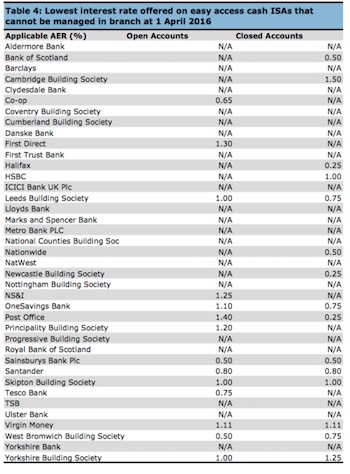

The FCA's name and shame list of low interest rates for cash saving accounts has listed some as paying 0.00%.

Data has been released as part of the FCA’s ‘sunlight remedy’ showing the lowest interest rates offered by 32 providers of easy access cash savings accounts and easy access cash ISAs.

The Post Office, First Direct and HSBC were the lowest, with 0.00%, according to the regulator's own tables, which are shown below.

Danske Bank and Ulster Bank have been cited in the FCA report as paying 0.01 per cent.

The lowest possible rates do not necessarily reflect the typical rate that a customer is earning, officials cautioned, explaining that some products offer different rates of interest where, for example, customers meet different conditions or according to the customer’s account balance, which might mean a higher rate of interest is paid.

Danny Cox, Chartered Financial Planner at Hargreaves Lansdown, said: “Long standing customers in closed accounts are getting a raw deal with many providers taking advantage. Providers seem perfectly happy to let savings held in closed accounts wither on the vine. This shows the importance of shopping around and switching accounts to make the most of your money.

"Savers breathed a sigh of relief last week as the Bank of England held interest rates at 0.5%, however this may well prove to be a 3 week stay of execution. Savers continue to feel the pain of low returns on cash but can take action to make their savings work harder”

Christopher Woolard, Director of Strategy and Competition at the FCA, said: “We said that one of our priorities this year will be focused on the treatment of long-standing customers. Our new rules, coming into force at the end of the year, will help consumers get the facts they need to make an informed decision about what to do with their savings.

“In a well-functioning market, providers should be competing to offer the best possible deal to consumers. Our sunlight remedy data shows that some consumers could be better off by opening a different account.”

FCA note on tables: The interest rates shown in tables are the lowest rates firms pay on accounts that do not have:

i. Any restrictions on deposits or withdrawals (other than those imposed by the ISA regulations)

ii. A notice period

iii. A minimuim operating balance requirement higher than £100

The sunlight remedy was one element of a broader package of remedies aimed at better outcomes for customers of cash savings accounts. From December 2016, firms will have to provide easy-to-understand key information in a summary box to help consumers compare savings accounts, as well as clearly reminding consumers about changes in interest rates or the end of an introductory rate. Firms will also be required to provide a quicker and easier switching process.