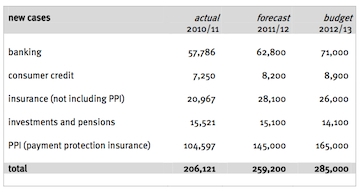

The Financial Ombudsman Service is gearing up for “unprecedented demand and volatility” as it expects to receive 285,000 complaints in the 2012/13 financial year.

This is up 10 per cent from the 259,000 cases in the current financial year.

More than half of these complaints are expected to relate to payment protection insurance (PPI) and the FOS expects to continue receiving PPI claims for the next two to three years.

It is currently receiving between 2,500 and 3,000 PPI cases every week.

FOS expects to resolve 130,000 of the forecast PPI complaints but admits that is dependent on “the co-operation we receive from both sides to complaints.”

Tony Boorman, principal ombudsman, said: “It’s disappointing that there’s little finality for significant numbers of consumers who are still waiting for their bank or insurer to deal with their complaint.

“The delays and inconvenience this causes consumers means the ombudsman now has to gear up for unprecedented demand and volatility in our workload.”

In order to fund the high number of PPI complaints, the FOS has proposed introducing a supplementary PPI case fee which would be payable by those businesses with over 25 cases per year.

This would involve a payment to the FOS of £350, in addition to the standard fee of £500, for each PPI case.

Payments would be made when a case becomes a formal complaint rather than when it is resolved.

FOS also expects to take on 655 additional staff during the financial year to cope with demand.

This includes 35 new ombudsmen and 510 new staff in the casework divisions, including adjudicators.

Over 80 per cent of FOS’ costs relate to staffing and it expects to spend £149m on staff and staff-related costs.

Forecasts for complaints regarding investments and pensions, the sector most likely to affect Financial Planners, stand at 14,100.

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.