Over a third of British consumers (37%) say they'll never save or invest for their retirement – compared to just 22 percent of people globally, according to a new study by Nielsen.

The global consumer research company says that its research shows that over a third (36%) of Britons have no confidence they will meet their financial goals either by sticking with their current savings and investment plans or by changing them in the future.

Britons, however, are more confident than Europeans as a whole (46%) in achieving their financial goals but less confident than people globally (31%). Europeans are the least confident in this regard among the five regions measured.

The Nielsen Global Survey of Saving and Investment Strategies polled more than 30,000 Internet respondents in 60 countries to evaluate how consumers around the world are preparing for current and future financial expenses. Nielsen evaluated 16 different saving and investment strategies used to fund a range of 14 long- and short-term financial goals.

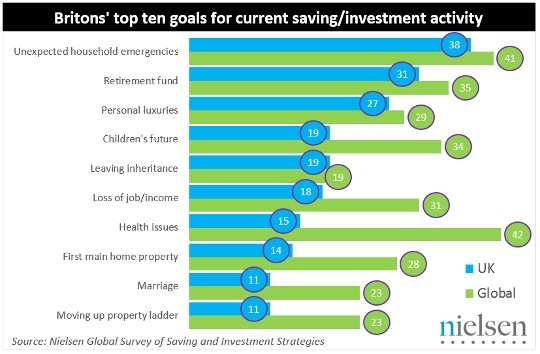

Britons who are currently saving or investing are doing it for many different reasons. Most popular is to cover household emergencies (38%), followed by saving/investing for retirement (31%) and for personal luxuries (27%) such as cars, holidays or watches (see chart). Choosing to save/invest now for personal luxuries is much more popular than saving/investing in long-term goals such as children's future, leaving an inheritance (both 19%) and higher education (10%).

In comparison, people globally are almost three times more likely than Britons to be saving/investing for higher education (28%) and almost twice as likely to be doing so for their children's future (34%).

{desktop}{/desktop}{mobile}{/mobile}

Nielsen senior vice president for financial services in Europe Eleni Nicholas said: "Britons appear much less involved in saving and investment activities than other consumers around the world.

"Our analysis shows the British are engaging in activity to meet, on average, just two-and-a-half financial goals, compared to four goals globally. Although retirement is high up on Britons' lists, it's still much less of a thought than it is around the world."

However, across 13 of the 14 financial goals measured, British consumers say they are more likely to engage in investment/saving activity in the future than they are now. Saving for unexpected household emergencies is the only exception.

The biggest gap between British consumers' current investment/saving activity, compared to their proposed future activity, is being able to fund health issues (15% now, to 36% in the future) followed by moving up the property ladder (11% now, to 31%) and addressing the loss of job/income (from 18% to 34%). A second home, starting a business and new baby are least important financial goals.

The Nielsen Global Survey of Saving and Investment Strategies was conducted between August 14 and September 6, 2013, and polled more than 30,000 consumers in 60 countries throughout Asia-Pacific, Europe, Latin America, the Middle East, Africa and North America.