Institute of Financial Planning sponsor firm Barclays Wealth has conducted a survey into female attitudes to Financial Planning.

The survey, which questioned over 2,000 high net worth individuals globally, found stark differences between male and female attitudes to Financial Planning.

Women wanted more discipline and self-control with their finances and wanted to make decisions themselves, making them less likely than men to use a financial adviser.

Some 64 per cent of women said they would visit a financial adviser compared to 69 per cent of men, despite saying they felt less confident in their financial expertise.

More discipline and self-control includes saving regularly, entering the market at uncertain times and adhering to a set financial plan.

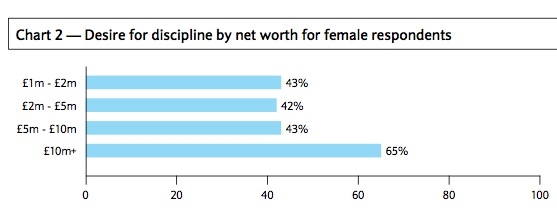

The figure was highest among those with the most money, 65 per cent of women with more than £10m wanted more discipline with their finances compared to 43 per cent of people with £1m-£10m.

They employed self-control strategies when investing such as avoiding information which might deviate them from their long-term plan and waiting before carrying out a big financial decision.

Women were also more risk-averse than men, only 33 per cent classified themselves as risk takers and only 31 per cent of women were willing to take higher risks on investments compared to 49 per cent of men.

Barbara-Ann King, head of female client group at Barclays Wealth, said: “This report shows the variations in how women and men think, behave and take action in their investment decision have far-reaching implications.

“As the rate of women’s wealth rises exponentially across the world, it is becoming increasingly vital that financial institutions and wealth managers address and understand these difference in order to cater for female clients more effectively, based on personality and lifestyle as well as gender.”

• Want to receive a free weekly summary of the best news stories from our website? Just go to home page and submit your name and email address. If you are already logged in you will need to log out to see the e-newsletter sign up. You can then log in again.