National advisory firm consolidator Succession is planning a ‘robo-advice-style’ service which will add human intervention to review any investment decisions.

Columbia Threadneedle Investments has this morning become the latest firm to axe its Brexit-triggered property fund suspension.

The creators of a new robo-service called Pension Monster are hoping to woo financial advisers as it launches today.

A bright blue double decker bus driven has begun a six day tour of the UK today espousing the benefits of saving for retirement.

Tracing lost pensions - new tool created to hunt them down

A new tool has been created to trace lost pensions.

A national wealth manager has opened up its thirteenth branch in the UK in Essex, saying it is filling an advice gap in the area left by the banks.

A prototype of the Pensions Dashboard will be ready by March 2017, the Government has revealed.

Retail investors have shifted their their attention towards global and income funds in July and August, according to an investment provider.

Morningstar, a provider of investment research, is to extend the Morningstar Analyst Ratings to exchange-traded funds globally, allowing investors to compare investments across fund types.

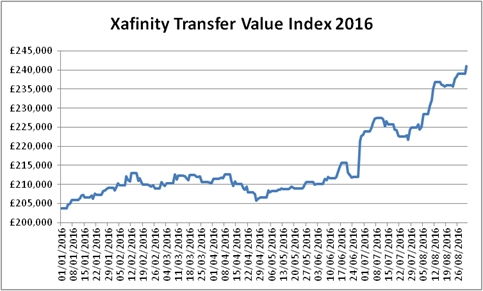

Pension transfer values have hit a record high and two pension providers have warned that growing transfer values could spur a growth in pension scams.