Expanding investment management and Financial Planning group Tilney has appointed Gary Jasper as a Financial Planner at its Chelmsford office as it ramps up recruitment.

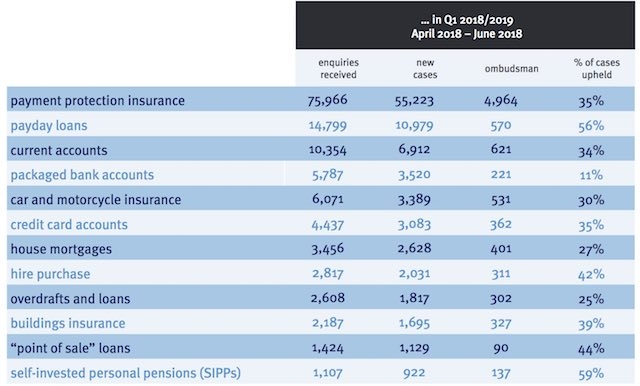

The Financial Ombudsman Scheme has reported a sharp rise in the number of new SIPPs cases in 2018 and is upholding an increasing number of complaints.

The Financial Services Compensation Scheme (FSCS) has declared nine firms in default today, paving the way for consumers to be compensated for their losses.

The Chartered Institute for Securities & Investment is urging UK Financial Planners to sign up for Financial Planning Week 2018 which runs from 3 to 10 October and aims to raise the national profile of Financial Planning through a campaign of consumer engagement.

The Financial Ombudsman Service has told banks they should take into account the “evolution and sophistication” of frauds and scams – and not simply assume that their customers were “grossly negligent.”

The Association of British Insurers has revealed that fraudsters are submitting a scam claim every minute of the day, underlining what it calls “the true extent of insurance fraud in the UK” which now amounts to £1.3bn a year.

The FCA is set to take over regulation of claims management companies and estimated the cost to be in the region of £17m.

The FCA has commenced a criminal prosecution against a man over unauthorised investment schemes.

Aberdeen Standard Investments has launched a new fund that utilises machine learning to identify sources of potential returns.

The tax collected from individuals breaching the Lifetime Allowance (LTA) has rocketed by £100m since it was introduced in 2006, with the latest figures showing that £110m in tax was collected from individuals exceeding the allowance during 2016/17, compared with less than £10m in 2006/7 when the LTA was introduced.