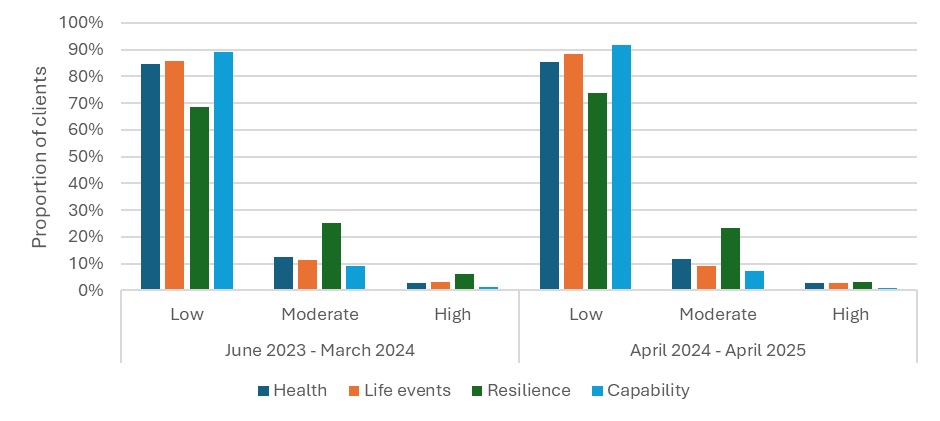

The overall proportion of clients with high levels of vulnerability has decreased over the past year, according to research by fintech Dynamic Planner.

It found that in 2024 to 2025 3.09% of clients were highly vulnerable in terms of their resilience.

That was less than half of the 6.26% of clients found to be highly vulnerable in 2023 to 2024.

The proportion of clients with moderate vulnerabilities also reduced year on year with more clients being viewed to have a low level of vulnerability.

That could indicate that for the more serious issues, clients are receiving welcome support and guidance that has proven reassuring, the firm said.

The figures support the FCA’s Financial Lives Survey latest 2024 findings, according to the fintech.

Dr Louis Williams, Dynamic Planner’s head of psychology and behavioural insights said: “At any point in time, a client can be considered vulnerable, whether due to a life event that causes them to become temporarily vulnerable or to a permanent change, for example due to a health condition.”

The figures are based on analysis of data from Dynamic Planner’s Financial Wellbeing Questionnaire, launched in 2023 to meet the requirements of Consumer Duty.

The company said it has enhanced the survey to help advice firms better understand client needs and differences.

It said the questionnaire allows advisers to assess individual clients across four key areas: health, life events, resilience, and capability.

Dr Williams said: “Importantly, we give control to the adviser to assess each client and uncover factors the client themselves might not consider as indicative of being in vulnerable circumstances.”

He said the questionnaire can be distributed through Fact Find invitations and the results, including a vulnerability status selected by the adviser, can be recorded on the client’s personal dashboard.