Financial Planner and wealth manager Tilney has strengthened its investment team with a new hire.

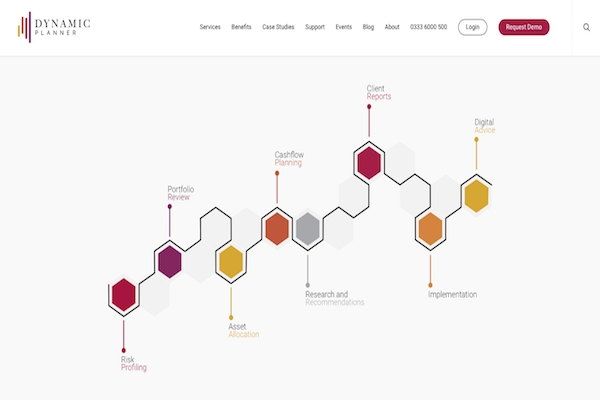

Dynamic Planner, the digital risk profiling and asset allocation investment service, has announced the launch of three major new integrations with leading industry providers.

National IFA firm AFH has boosted funds under management by 68%, according to its latest half-year results.

UK-based wealth manager Kingswood has revealed it has acquired an interest in Manhattan Harbor Capital Inc.

Research for IFA network Openwork has revealed growing untapped demand for financial advice.

New research has predicted a 7% fall in the number of IFAs and wealth managers by 2022, despite rising demand for financial advice.

Industry experts believe that the resignation of Prime Minister Theresa May today makes a General Election and a new EU Referendum more likely.

Multi-national, South African-owned financial provider Old Mutual Limited (OML) has suspended its chief executive Peter Moyo.

Nearly 6 million people would be willing to pay for financial advice if it cost less, new consumer research has suggested.

Analysis of government data by a Financial Planner and wealth manager has revealed that women expect to have a pension pot of £168,000 when they retire, almost £100,000 less than men.